Maurices Credit Card: Your Passport to Fashion Savings

Maurices credit card is a great way to save money on your purchases at Maurices, a popular clothing store for women. With this card, you can earn points on every purchase, which can be redeemed for discounts on future purchases. You'll also get exclusive discounts and offers, as well as free shipping on all orders.

Unlocking the Rewards Potential of the Maurices Credit Card

For fashion-forward individuals seeking to maximize their shopping experience at Maurices, the Maurices credit card emerges as a compelling financial companion. This meticulously crafted credit card not only grants access to exclusive discounts and offers but also unlocks a treasure trove of rewards that transform ordinary purchases into lucrative endeavors. Embark on a journey to uncover the hidden rewards potential of the Maurices credit card and elevate your shopping experience to new heights.

Earning Points with Every Purchase

At the heart of the Maurices credit card lies a rewarding points system that transforms every purchase into an opportunity to accumulate valuable rewards. With every dollar spent, you'll earn a designated number of points, steadily building your rewards portfolio. These points act as your gateway to a myriad of benefits, from enticing discounts to exciting shopping perks.

Redeeming Points for Rewarding Experiences

Once your points balance reaches a certain threshold, the true magic of the Maurices credit card unfolds. You'll have the power to redeem your accumulated points for a variety of rewarding experiences, including:

- Direct discounts on future purchases: Transform your points into instant savings, reducing the cost of your next Maurices shopping spree.

- Exclusive rewards and offers: Unlock access to special promotions, limited-time deals, and exclusive events, all tailored to enhance your Maurices experience.

- Birthday treats and surprises: Celebrate your special day with a delightful birthday gift from Maurices, a token of appreciation for your loyalty.

Maximizing Your Rewards Potential

To truly harness the rewards potential of the Maurices credit card, consider implementing these strategic approaches:

- Enroll in the mymaurices rewards program: Combine the power of the credit card with the mymaurices rewards program, amplifying your points earning potential.

- Embrace double points events: Keep an eye out for double points events, where your points accumulate twice as fast, accelerating your rewards journey.

- Shop during exclusive cardholder promotions: Utilize your credit card to its full potential by taking advantage of exclusive cardholder discounts and offers.

Unveiling a World of Benefits

Beyond its rewarding capabilities, the Maurices credit card offers a plethora of additional benefits that elevate your shopping experience:

- Free shipping on every order: Eliminate shipping costs and enjoy seamless delivery on all your Maurices purchases.

- 10% off every time you shop: Indulge in everyday savings with an exclusive 10% discount on all Maurices merchandise.

- Access to special sales and events: Stay ahead of the fashion curve with early access to exclusive sales and events, ensuring you never miss out on the latest trends.

Making an Informed Decision

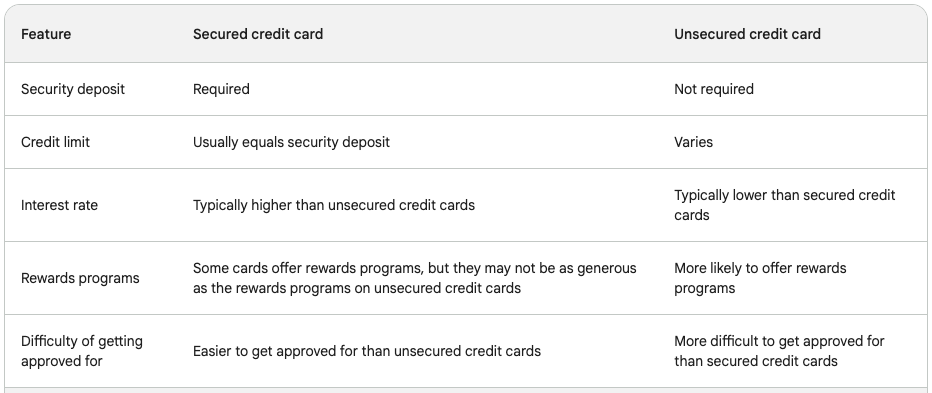

Before embarking on your rewards-driven journey with the Maurices credit card, carefully consider your financial situation and spending habits. Assess your credit score, income, and expenses to ensure the card aligns with your overall financial goals. Evaluate the annual fee and interest rates, ensuring you understand the financial implications.

Streamlined Application Process

The Maurices credit card offers a simple and streamlined application process that allows you to start enjoying its benefits in no time. Here's how to quickly and easily apply for your Maurices credit card:

Online Application

- Visit the Maurices Credit Card website: Navigate to the Maurices credit card website using your preferred web browser.

- Locate the "Apply Now" button: On the credit card's landing page, you'll find a prominent "Apply Now" button. Click on this button to initiate the application process.

- Enter your personal information: Provide your full name, address, phone number, and email address accurately.

- Furnish your Social Security number and date of birth: These details are required for credit verification purposes.

- Review and submit your application: Carefully review the information you've provided and ensure it's accurate. Once satisfied, submit your application by clicking the "Submit" button.

In-Store Application

- Visit a Maurices store: Locate your nearest Maurices store and visit during its regular operating hours.

- Approach a customer service representative: Inform the representative of your desire to apply for the Maurices credit card.

- Provide your personal information: Similar to the online process, you'll need to provide your name, address, phone number, email address, Social Security number, and date of birth.

- Complete the application form: The customer service representative will assist you in completing the application form, ensuring accuracy and completeness.

- Submit your application: Once the application is complete, submit it to the customer service representative for processing.

Application Review and Approval

Upon submitting your application, either online or in-store, Maurices will review your credit history and financial information to determine your eligibility for the credit card. You will receive a notification regarding the approval or denial of your application within a few business days.

Approved Applicants

If your application is approved, you will receive your Maurices credit card within 7-10 business days. Upon receiving your card, activate it by following the instructions provided. You can now start enjoying the benefits of your Maurices credit card.

Denied Applicants

In case your application is denied, you will receive a notification outlining the reasons for the denial. You can review these reasons and consider reapplying in the future once you've addressed any credit or financial concerns.

Additional Considerations

- Credit score: Your credit score plays a significant role in determining your eligibility for the Maurices credit card. A higher credit score increases your chances of approval.

- Income and expenses: Maurices will also consider your income and expenses to assess your ability to manage credit repayments. A stable income and manageable expenses enhance your application's strength.

Savvy Strategies for Utilizing the Maurices Credit Card

- Maximize point accumulation:

- Enroll in the mymaurices rewards program: Combine the power of the credit card with the mymaurices rewards program to accelerate your points earning potential.

- Be mindful of double points events: Keep an eye out for double points events, where your points accumulate twice as fast, making your rewards journey more rewarding.

- Shop during exclusive cardholder promotions: Utilize your credit card strategically by taking advantage of exclusive cardholder discounts and offers to boost your point earnings.

- Redeem points wisely:

- Seek out high-value redemption opportunities: Save your points for larger purchases or exclusive redemption options to maximize their value.

- Combine points with sales: Time your point redemptions to coincide with sales or clearance events to enjoy even greater savings.

- Consider gift card redemptions: Redeem your points for Maurices gift cards to have a flexible currency for future purchases.

- Take advantage of cardholder benefits:

- Enjoy free shipping on every order: Eliminate shipping costs and enjoy seamless delivery on all your Maurices purchases.

- Indulge in everyday savings with a 10% discount: Take advantage of the exclusive 10% discount on all Maurices merchandise, making every purchase more rewarding.

- Stay ahead of the fashion curve with early access to special sales and events: Ensure you never miss out on the latest trends by accessing exclusive sales and events before the general public.

- Manage your credit responsibly:

- Always make payments on time: Avoid late fees and maintain a positive credit history by making payments on time each month.

- Keep your balance manageable: Avoid carrying large balances to minimize interest charges and maintain financial control.

- Monitor your spending: Regularly review your credit card statements to ensure you're staying within your budget and using your card responsibly.

- Evaluate your usage periodically:

- Assess your rewards earnings: Regularly review your points balance and assess whether your current usage pattern aligns with your rewards goals.

- Consider your financial situation: Evaluate your financial situation and spending habits to ensure the card continues to align with your overall financial goals.

- Seek alternative options if needed: If your needs or financial situation change, explore other credit card options that may better suit your current circumstances.

By employing these savvy strategies, you can harness the power of the Maurices credit card to elevate your shopping experience, maximize rewards, and manage your finances responsibly.

Delving into the Fees and Interest Rates of the Maurices Credit Card

While the Maurices Credit Card offers a plethora of benefits and rewards, it's crucial to understand its fees and interest rates to make informed financial decisions. Let's delve into the financial aspects of this credit card to ensure you're well-equipped to manage your account responsibly.

- Annual Fee: The Maurices Credit Card has an annual fee of $29, which is charged annually upon account activation and renewal. This fee is relatively standard among store-specific credit cards.

- Interest Rates: The Maurices Credit Card has a variable purchase APR of 29.99%. This means that the interest rate you pay on your purchases will fluctuate based on the prime rate, which is set by the Federal Reserve. The current prime rate is 3.25%, so your APR would be 33.24%.

- Other Fees: In addition to the annual fee and interest charges, the Maurices Credit Card may incur other fees depending on your usage:

- Late payment fee: $35 if your payment is 15 days or more past due.

- Balance transfer fee: 3% of the balance transferred.

- Returned payment fee: $30 if your payment is not honored.

- Cash advance fee: 3% of the cash advance amount, with a minimum fee of $5.

- Understanding the Impact of Fees and Interest Rates: The fees and interest rates associated with the Maurices Credit Card can significantly impact your overall financial situation if not managed carefully. Here's how these charges can affect your finances:

- Late payment fees: Late payments can quickly add up and strain your budget. Paying your bill on time is essential to avoid these unnecessary expenses.

- Balance transfer fees: If you plan to transfer balances from other credit cards to the Maurices Credit Card, consider the balance transfer fee, as it can erode the potential savings from a lower interest rate.

- Cash advance fees: Cash advances typically have higher interest rates than purchases, so it's generally advisable to avoid using your credit card for cash withdrawals.

Strategies to Minimize Fees and Interest Charges

To minimize the impact of fees and interest charges on your Maurices Credit Card, consider these strategies:

- Pay your bill on time or in full each month: This is the most effective way to avoid late payment fees and interest charges.

- Keep your balance low: Carrying a large balance can lead to substantial interest charges. Aim to pay off your balance in full each month to avoid interest accrual.

- Utilize the card strategically: Use your Maurices Credit Card for purchases you would make anyway and avoid unnecessary spending.

- Monitor your account regularly: Regularly review your credit card statements to ensure there are no unauthorized charges or unexpected fees.

Making Informed Decisions

Before applying for the Maurices Credit Card, carefully evaluate your financial situation and spending habits. Consider whether the card's benefits align with your needs and whether you can manage the associated fees and interest rates responsibly.

Enhancing Your Shopping Experience with the Maurices Credit Card

The Maurices Credit Card is a great way to enhance your shopping experience at Maurices, a popular clothing store for women. With this card, you can earn points on every purchase, which can be redeemed for discounts on future purchases. You'll also get exclusive discounts and offers, as well as free shipping on all orders.

But there are even more ways to get the most out of your Maurices Credit Card. Here are a few tips:

- Take advantage of double points events.

- Maurices often has double points events, so you can earn twice as many points on your purchases. These events are usually announced in advance, so be sure to check the Maurices website or sign up for email alerts.

- Sign up for the mymaurices rewards program.

- The mymaurices rewards program is a free loyalty program that allows you to earn points on your Maurices purchases, as well as get exclusive discounts and offers. You can even earn points on your online purchases.

- Shop during cardholder sales and events.

- Maurices often has special sales and events just for cardholders. These events are a great way to save even more money on your purchases.

- Use your card for online purchases.

- You can use your Maurices Credit Card for online purchases, as well as in-store purchases. This is a great way to earn points on all of your Maurices purchases.

- Take advantage of free shipping.

- Maurices offers free shipping on all orders, no matter how much you spend. This is a great way to save money on shipping costs.

- Use your card for exclusive rewards.

- Maurices often has exclusive rewards for cardholders, such as free gifts, discounts on special items, and early access to sales.

- Make payments on time.

- It's important to make payments on your Maurices Credit Card on time to avoid late fees. Late fees can add up quickly and can negate the savings you've earned through points and discounts.

- Monitor your account balance.

- It's also important to monitor your account balance regularly to avoid overspending. Overspending can lead to high interest charges and can damage your credit score.

By following these tips, you can enhance your shopping experience with the Maurices Credit Card and make the most of its many benefits.

Conclusion

The maurices credit card isn't just a financial tool; it's a style companion that adds a touch of exclusivity to your wardrobe. Apply today to elevate your fashion game, unlock savings, and become part of a community that celebrates style with purpose. Your journey to a more stylish and financially savvy lifestyle begins with the maurices credit card.

Frequently Asked Questions

Applying for a maurices credit card is simple. Visit the maurices website or inquire at your local store for an application form. Complete the form, submit the necessary information, and await the quick approval process.

With the maurices credit card, you earn points for every dollar spent, which can later be redeemed for discounts on your purchases. The more you shop, the more points you accumulate, enhancing your savings on fashionable finds.

Absolutely! credit cardholders enjoy exclusive access to special discounts and promotions, including seasonal sales and member-only events. These perks provide extra savings and a unique shopping experience.

Yes, maurices offers a user-friendly online account management system. You can track your purchases, manage payments, and stay updated on exclusive offers, providing convenient control over your fashion finances.

Celebrate your birthday in style with maurices credit card. Cardholders receive special birthday bonuses, such as additional discounts or rewards, adding a touch of joy to your special day.

The approval process for a credit card is designed to be quick and hassle-free. In many cases, applicants receive approval promptly, allowing them to start enjoying the benefits of the card without unnecessary delays.

Yes, keep up with modern payment trends with maurices credit card's contactless payment options. Enjoy a seamless and secure checkout experience, whether you're shopping in-store or online.

maurices values social responsibility. While specific initiatives may vary, maurices credit cardholders may have opportunities to participate in charitable activities, allowing them to contribute to meaningful causes while enjoying their passion for fashion.

Joining the maurices community as a credit cardholder offers exclusive benefits, including early access to trends, style tips, and invitations to special events. Connect with like-minded fashion enthusiasts and stay at the forefront of the latest in style.

maurices credit cardholders can enjoy their fashion perks without worrying about annual fees. maurices typically does not charge an annual fee for their credit card, making it a cost-effective choice for style-conscious shoppers.