Christmas loans are a specialized form of personal loan tailored to address the unique financial needs that come with the holiday season. These loans are designed to provide the necessary funds to cover everything from gift shopping and festive decorations to travel expenses and hosting memorable gatherings.

Navigating the Holiday Season with Christmas Loans

The holiday season is a time for joy, celebration, and, often, financial stress. The pressure to buy gifts, travel to see family, and host festive gatherings can strain even the most carefully planned budgets. This is where Christmas loans come in.

Advantages of Christmas Loans:

- Spread the Cost: Christmas loans allow you to spread the cost of holiday expenses over a manageable period, preventing a sudden strain on your finances.

- Avoid High-Interest Debt: Compared to credit cards, which can carry high-interest rates, Christmas loans can offer more affordable repayment options, saving you money in the long run.

- Enjoy the Holidays with Ease: Christmas loans can alleviate financial stress during the holidays, allowing you to fully embrace the festivities without worrying about immediate financial pressures.

- Peace of Mind: Knowing that you have the funds to cover your holiday expenses can provide much-needed peace of mind during the holiday season.

Disadvantages of Christmas Loans:

- Added Debt: Taking on additional debt, even for a short period, can increase your overall financial obligations. It's crucial to carefully assess your financial situation before applying for a loan.

- Potential Fees: Christmas loans may incur origination fees, late payment fees, and other charges that can add to the overall cost. Carefully review the loan agreement to understand all potential fees.

- Credit Score Impact: Applying for a Christmas loan can result in a hard inquiry on your credit report, which could temporarily affect your credit score. Avoid applying for multiple loans within a short period to minimize the impact on your credit score.

Before Applying for a Christmas Loan:

- Evaluate Your Needs: Before resorting to a loan, realistically assess your holiday expenses to determine the actual amount you need to borrow. Avoid unnecessary borrowing and make a detailed budget outlining your holiday expenses.

- Compare Lenders: Don't settle for the first lender you come across. Shop around and compare interest rates, terms, and fees from different lenders to secure the most favorable deal. Utilize online resources and loan aggregators to compare multiple lenders simultaneously.

- Explore Alternatives: Before committing to a Christmas loan, explore alternative options, such as utilizing savings or seeking financial assistance from family or friends, to minimize debt accumulation. Consider utilizing savings accounts, credit card rewards, or selling unused items to fund your holiday expenses.

- Ensure Repayment Affordability: Calculate your monthly payments and ensure they fit comfortably within your budget. Don't overextend yourself financially and ensure that the loan payments align with your monthly income and expenses.

- Scrutinize the Fine Print: Thoroughly review the loan agreement, paying close attention to the interest rate, repayment terms, potential penalties, and any hidden charges. Understand the terms and conditions of the loan before signing any documents.

Responsible Christmas Loan Usage:

- Create a Repayment Plan: Develop a structured repayment plan that aligns with your income and expenses to avoid any missed payments. Stick to your repayment plan to avoid late fees and potential damage to your credit score.

- Stick to Your Budget: Avoid impulse purchases and unnecessary spending to prevent further financial strain. Prioritize essential holiday expenses and stick to your budget to avoid overspending.

- Consider Early Repayment: If possible, consider making early repayments to reduce the overall interest paid and shorten the loan term, saving you money in the long run.

- Maintain Open Communication: Keep your lender informed in case of any unexpected financial circumstances to avoid potential complications. Communicate promptly with your lender if you encounter any difficulties with repayments.

Understanding the Benefits

Here are some of the key benefits of unsecured Christmas loans:

- Flexibility: Unsecured Christmas loans can be used to cover a wide range of holiday expenses, including gifts, travel, decorations, food, and entertainment. This flexibility allows you to prioritize your spending and allocate funds where they are needed most.

- Convenient Application Process: Unsecured Christmas loans typically have a straightforward application process, often completed online or through a mobile app. This convenience makes it easier to apply for a loan and receive funding quickly, especially during the busy holiday season.

- Fixed Interest Rates: Unsecured Christmas loans typically feature fixed interest rates, which means that your monthly payments will remain the same throughout the loan term. This predictability can help you plan your budget and avoid unexpected interest fluctuations.

- No Collateral Required: Unlike secured loans, unsecured Christmas loans do not require you to put up any collateral to secure the loan. This can be a significant advantage for individuals who may not have valuable assets to pledge as security.

- Credit Score Improvement: Making timely payments on your unsecured Christmas loan can help improve your credit score. A good credit score can be beneficial for future loan applications and may lead to more favorable interest rates.

How to Secure the Perfect Christmas Loan for Your Needs

Christmas loans can be a lifeline to ensure your holiday season is special without straining your budget. here is a guide through the steps to secure the perfect Christmas loan tailored to your needs, so you can enjoy the festivities with peace of mind.

- Assess Your Holiday Budget: Before seeking a Christmas loan, take a close look at your holiday budget. Determine how much you need to cover your holiday expenses, including gifts, travel, decorations, and any special events you plan to host. Having a clear understanding of your budget will help you decide the loan amount you need.

- Research Lenders: Not all Christmas loans are created equal, so it's essential to research and compare different lenders. Look for lenders that offer competitive interest rates, favorable terms, and flexible loan amounts. Online research and customer reviews can help you identify reputable lending institutions.

- Check Your Credit Score: Your credit score plays a significant role in the terms and interest rates you'll be offered. Before applying for a Christmas loan, obtain a copy of your credit report and address any discrepancies or areas for improvement. A higher credit score can open doors to better loan options.

- Determine the Loan Amount: Based on your holiday budget and financial assessment, determine the loan amount that suits your needs. It's important to borrow only what you need to avoid unnecessary debt.

- Prepare Financial Documentation: Lenders will require proof of income and financial documentation. Gather your pay stubs, bank statements, and any other relevant financial documents to streamline the application process.

- Compare Loan Terms: When you've narrowed down your list of potential lenders, compare the loan terms and conditions. Pay attention to the interest rate, loan term, and repayment options. Choose a loan with terms that align with your budget and financial goals.

- Apply Online: Many lenders offer convenient online application processes. Fill out the application accurately and provide all necessary documentation. Be prepared to undergo a credit check during the application process.

- Read the Fine Print: Before accepting a Christmas loan, carefully read the terms and conditions outlined in the loan agreement. Ensure you understand the interest rate, repayment schedule, and any potential fees associated with the loan.

- Receive Approval and Funds: Once your application is approved, the lender will provide you with the funds. Make sure you use the loan responsibly and only for holiday-related expenses.

- Budget Wisely: With your Christmas loan in hand, create a budget for the holiday season. Allocate funds to various expenses and commit to responsible spending to ensure you can comfortably repay the loan without financial strain.

Christmas Loans vs. Credit Cards: Which is the Better Choice?

When it comes to financing your holiday expenses, two popular options are Christmas loans and credit cards. Both offer unique features and drawbacks, making the decision of which one is better for you depend on your specific financial situation and needs.

Christmas Loans:

Advantages:

- Fixed interest rates: Christmas loans typically have fixed interest rates, meaning your monthly payments will remain the same throughout the loan term. This predictability can help you plan your budget and avoid unexpected interest fluctuations.

- Repayment terms: Christmas loans typically have repayment terms ranging from several months to a year, allowing you to spread out the cost of holiday expenses over a manageable period.

- No collateral required: Unlike secured loans, unsecured Christmas loans do not require you to put up any collateral to secure the loan. This can be a significant advantage for individuals who may not have valuable assets to pledge as security.

Disadvantages:

- Added debt: Taking on additional debt, even for a short period, can increase your overall financial obligations. It's crucial to carefully assess your financial situation before applying for a loan.

- Potential fees: Christmas loans may incur origination fees, late payment fees, and other charges that can add to the overall cost. Carefully review the loan agreement to understand all potential fees.

Credit Cards:

Advantages:

- Flexibility: Credit cards offer flexibility in how you spend the money, allowing you to make purchases beyond holiday expenses.

- Rewards programs: Many credit cards offer rewards programs, such as cash back or travel points, which can provide additional benefits when used responsibly.

- Convenience: Credit cards are convenient for making online or in-store purchases, eliminating the need for cash or a separate loan application.

Disadvantages:

- Variable interest rates: Credit cards typically have variable interest rates, meaning your monthly payments can fluctuate based on the current market rate. This can make budgeting more challenging.

- Revolving debt: Credit cards are a form of revolving debt, meaning that your balance carries over from month to month if not paid in full. This can lead to accumulating interest charges and potential financial strain if not managed responsibly.

- Impact on credit score: Credit card utilization, the percentage of your credit limit that you're using, can significantly impact your credit score. High utilization can lower your score and make it more difficult to qualify for favorable interest rates on loans in the future.

Making an Informed Decision:

The decision between Christmas loans and credit cards depends on your individual circumstances. If you prefer predictable monthly payments and a structured repayment plan, a Christmas loan may be a better choice. If you prioritize flexibility, rewards, and convenience, a credit card may be more suitable.

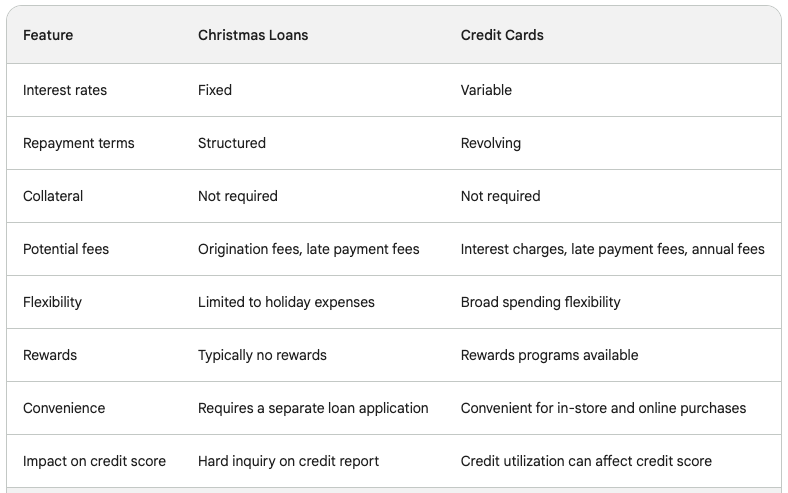

Here's a table summarizing the key differences between Christmas loans and credit cards:

Ultimately, the best choice for you depends on your financial situation, spending habits, and repayment capabilities. Carefully assess your needs and goals before deciding which option is right for you.

Effective Budgeting with Christmas Loans: Tips and Strategies

Christmas loans can be a valuable tool to help you manage holiday expenses and avoid financial strain during the festive season. However, it's crucial to use Christmas loans responsibly and incorporate them into an effective budgeting plan to ensure a smooth repayment process and maintain long-term financial well-being.

Here are some tips and strategies for effective budgeting with Christmas loans:

- Evaluate Your Needs and Create a Realistic Budget: Before applying for a Christmas loan, realistically assess your holiday expenses, including gifts, travel, decorations, food, and entertainment. Create a detailed budget to track your expected spending and determine the actual amount you need to borrow.

- Set Clear Financial Goals: Establish clear financial goals for your Christmas spending. Determine how much you can comfortably allocate towards gifts, travel, and other expenses without overextending your budget.

- Prioritize Essential Expenses: Prioritize essential holiday expenses, such as gifts for immediate family and close friends. Avoid impulse purchases or unnecessary spending that can strain your finances.

- Utilize Existing Savings: Before resorting to a loan, consider utilizing your existing savings to cover a portion of your holiday expenses. This can reduce the amount you need to borrow and minimize the overall interest paid.

- Explore Alternative Funding Options: Consider alternative funding options, such as seeking financial assistance from family or friends or utilizing rewards programs or credit card points, to reduce your reliance on loans.

- Compare Loan Options and Terms: Shop around and compare interest rates, terms, and fees from different lenders to secure the most favorable loan offer. Utilize online resources and loan aggregators to compare multiple lenders simultaneously.

- Calculate Monthly Payments: Before accepting a loan offer, calculate your monthly payments to ensure they fit comfortably within your budget. Consider using a loan calculator to estimate your monthly obligations.

- Create a Repayment Plan: Develop a structured repayment plan that aligns with your income and expenses to avoid any missed payments. Consider making additional payments whenever possible to reduce the overall interest paid and shorten the loan term.

- Stick to Your Budget: Avoid impulse purchases and unnecessary spending throughout the holiday season. Stay disciplined with your budget to ensure you can manage your holiday expenses and loan repayments effectively.

- Track Your Spending: Regularly track your spending and compare it to your budget to identify areas where you can cut back or adjust your spending habits.

- Communicate with Your Lender: Maintain open communication with your lender. If you encounter any unexpected financial difficulties or need to make changes to your repayment plan, inform your lender promptly to avoid potential complications.

- Prioritize Financial Wellness: Remember that the true spirit of the holidays lies in love, togetherness, and creating lasting memories, not in the material possessions. Focus on enjoying the season with loved ones and prioritize your overall financial well-being.

By following these tips and strategies, you can effectively manage your holiday expenses with Christmas loans and ensure a financially sound holiday season. Remember, responsible financial planning and budgeting are key to a stress-free and enjoyable holiday experience.

Conclusion

Christmas loans can be a valuable tool when used responsibly and with careful consideration. By understanding the pros and cons, evaluating your needs, and practicing financial prudence, you can navigate the holiday season with peace of mind and financial well-being. Remember, the true spirit of the holidays lies in love, togetherness, and creating lasting memories, not in the material possessions. Embrace the season of giving and joy, and let the festive spirit fill your hearts and homes.

Frequently Asked Questions

What are Christmas loans, and how do they work?Christmas loans are specialized personal loans designed to cover holiday-specific expenses. They work like traditional personal loans but are tailored to help you finance your holiday celebrations.

Are Christmas loans unsecured?Yes, most Christmas loans are unsecured, meaning you don't need to provide collateral, such as your home or car, to secure the loan.

What expenses can I cover with a Christmas loan?Christmas loans can be used to cover a wide range of holiday expenses, including gift shopping, travel, decorations, hosting gatherings, and any other holiday-related costs.

What are the advantages of using a Christmas loan?The advantages include financial flexibility, competitive interest rates, predictable payments, and the ability to avoid high credit card interest rates.

Is a good credit score necessary to secure a Christmas loan?While a good credit score can help you secure more favorable terms, there are options for individuals with various credit scores. Lenders may offer loans with different interest rates based on creditworthiness.

How do I secure a Christmas loan?To secure a Christmas loan, you typically need to research lenders, assess your holiday budget, gather financial documentation, complete the application process, and meet the lender's approval criteria.

What is the difference between Christmas loans and credit cards for holiday expenses?Christmas loans usually offer lower interest rates compared to credit cards, making them a more cost-effective option for financing holiday expenses. Additionally, they have fixed repayment terms.

Can I repay a Christmas loan early without penalties?It depends on the lender and the terms of the loan. Some lenders allow early repayment without penalties, while others may charge a fee or have restrictions.

What happens if I can't repay my Christmas loan on time?If you're unable to repay your Christmas loan on time, contact your lender to discuss your situation. Some lenders may offer extensions or alternative repayment arrangements, while others may charge late fees.

Can I use a Christmas loan for non-holiday expenses?Christmas loans are intended for holiday-related expenses. While you might be able to use the funds for other purposes, it's best to consult with the lender to ensure you comply with the loan agreement.