Credit cards for bad credit aren't just financial products; they're lifelines for individuals striving to navigate their way out of murky financial waters. In an era where creditworthiness is paramount, these cards offer a chance for many to rewrite their financial narratives. Dive with us into the realm of these unique cards, understanding their purpose, advantages, and the best ways to harness their potential.

The Essence: Defining Credit Cards for Bad Credit

Crafted explicitly for those whose credit histories have seen better days or for those just beginning their credit journey, these cards are bridges to rebuilding or establishing one's credit reputation. They act as both a challenge and an opportunity-offering a fresh start while demanding meticulous financial management.

What are the Benefits?

There are a number of benefits to using credit cards, including:

- Rebuilding your credit score: When you use a credit card responsibly and make your payments on time and in full each month, you can help to improve your credit score. This is because credit bureaus look at your payment history as one of the most important factors when determining your credit score.

- Establishing a credit history: If you don't have any credit history, getting approved for a credit card for bad credit can be a good way to start building your credit history. Once you have a credit history, you will be more likely to be approved for loans and other forms of credit in the future.

- Access to credit: Even if you have bad credit, a credit card can give you access to credit that you can use to make purchases or cover unexpected expenses. This can be helpful if you are in a financial bind.

- Rewards programs: Some credit cards offer rewards programs, such as cash back, travel rewards, or points that can be redeemed for merchandise. While the rewards programs on these cards may not be as generous as the rewards programs on cards for people with good credit, they can still be a good way to earn rewards on your spending.

It is important to note that credit cards for bad credit typically have higher interest rates and lower credit limits than traditional credit cards. This is because the lender is taking on more risk by lending money to someone with bad credit. However, if you are able to use your credit card responsibly and make your payments on time and in full, you can still benefit from using a credit card for bad credit.

Types of Credit Cards for Bad Credit

There are two main types of credit cards: secured credit cards and unsecured credit cards.

- Secured credit cards require you to make a security deposit, which usually equals your credit limit. This deposit protects the lender in case you default on your payments. Secured credit cards are a good option for people with bad credit or no credit history because they are easier to get approved for than unsecured credit cards.

- Unsecured credit cards do not require a security deposit. However, they are more difficult to get approved for and typically have higher interest rates than secured credit cards. Unsecured credit cards are a good option for people who have already started to rebuild their credit and are looking for a card with more features and benefits.

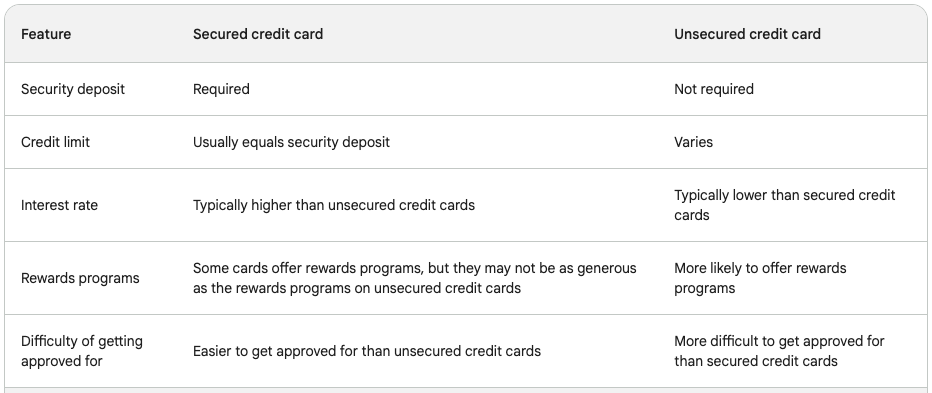

Here is a table comparing secured and unsecured credit cards:

If you are considering getting a credit card for bad credit, it is important to compare different cards and choose one that has the best terms and conditions for your situation. You should also consider your financial goals and spending habits when choosing a card. For example, if you are trying to rebuild your credit score, you may want to choose a secured credit card with a low interest rate. If you are looking for a card with rewards, you may want to choose an unsecured credit card with a rewards program that aligns with your spending habits.

How to Choose the Best Credit Card for Bad Credit

When choosing the best credit card for bad credit, it is important to consider the following factors:

- Interest rate: The interest rate is the amount of interest you will pay on your credit card balance if you don't pay it off in full each month. Credit cards for bad credit typically have higher interest rates than traditional credit cards, but there is still a range of interest rates available. Look for a card with the lowest interest rate possible to minimize your interest charges.

- Annual fee: Some credit cards charge an annual fee. This is a recurring fee that you will pay each year, regardless of how much you use your card. If you're on a tight budget, you may want to avoid cards with annual fees.

- Credit limit: The credit limit is the maximum amount of money you can borrow on your credit card. Credit cards for bad credit typically have lower credit limits than traditional credit cards. Choose a credit limit that is appropriate for your needs and budget.

- Rewards programs: Some credit cards offer rewards programs, such as cash back, travel rewards, or points that can be redeemed for merchandise. While the rewards programs on credit cards may not be as generous as the rewards programs on cards for people with good credit, they can still be a good way to earn rewards on your spending.

- Additional features and benefits: Some credit cards offer additional features and benefits, such as fraud protection, purchase protection, and extended warranties. Consider which features and benefits are important to you when choosing a card.

Once you have considered all of these factors, you can start comparing different credit cards and choose one that has the best terms and conditions for your situation.

Here are some additional tips for choosing the best credit card for bad credit:

- Read the fine print carefully before applying for a credit card. Make sure you understand all of the terms and conditions, including the interest rate, annual fee, and rewards program.

- Compare offers from multiple lenders before you choose a card. This will help you to find the best deal possible.

- Be honest about your financial situation on your credit card application. This will increase your chances of getting approved for a card and getting a good interest rate.

By following these tips, you can choose the best credit card for bad credit and start rebuilding your credit score.

How to get approved for a credit card for bad credit

Getting approved for a credit card when you have bad credit can seem challenging, but it's not impossible. By being strategic and informed, you can increase your chances of approval. Here's a step-by-step guide to help you navigate this process:

- Understand Your Credit Score:

- Before applying, obtain a copy of your credit report and score from major credit bureaus (Equifax, Experian, and TransUnion). This will give you a clear understanding of where you stand.

- Review the report for any errors or inaccuracies and dispute them if necessary.

- Research Suitable Credit Cards:

- Look for credit cards specifically designed for people with bad credit or no credit history. These may include secured credit cards or subprime credit cards.

- Compare the terms, fees, interest rates, and other features of these cards to find the best fit for you.

- Consider Secured Credit Cards:

- A secured credit card requires a refundable security deposit, which usually determines your credit limit.

- Since you provide collateral (the deposit), issuers are more willing to approve applicants with bad credit.

- Limit the Number of Applications:

- Every credit card application results in a hard inquiry on your credit report, which can temporarily lower your credit score.

- It's advisable to apply for one card at a time and wait for a decision before trying another.

- Provide Accurate and Consistent Information:

- When filling out the application, ensure all the information is accurate and consistent with what's on your credit report.

- This can speed up the approval process and reduce the chances of red flags for lenders.

- Consider a Co-signer:

- Some credit cards allow a co-signer. Having someone with good credit co-sign your application can increase your chances of approval.

- However, remember that the co-signer will be responsible for the debt if you default.

- Check for Pre-qualification Options:

- Many issuers offer online pre-qualification tools that allow you to see if you might be approved before you apply officially.

- These usually involve soft inquiries, which don't impact your credit score.

- Reevaluate Finances & Demonstrate Stability:

- Lenders appreciate applicants who show signs of financial stability. This can include consistent employment, a steady income, and a history of paying bills on time.

- If possible, try to reduce outstanding debts, as lenders will consider your debt-to-income ratio.

- Be Prepared for Higher Costs:

- Credit cards for bad credit often come with higher interest rates, annual fees, and other charges.

- Ensure you're aware of these costs and are prepared to manage them responsibly.

- Maintain Persistence and Patience:

- If denied, request an explanation. This can give you insights into what you might need to improve.

- Consider waiting a few months, working on improving your credit, and then reapplying.

How to use a credit card for bad credit responsibly

Once you're approved for a credit card, it's important to use it responsibly. Here are a few tips:

- Pay your bill on time and in full each month. This is the most important thing you can do to build your credit score and avoid late fees and interest charges.

- Keep your credit utilization ratio low. Your credit utilization ratio is the amount of credit you're using compared to your total available credit. It's best to keep your credit utilization ratio below 30%.

- Avoid maxing out your credit cards. Maxing out your credit cards can damage your credit score and make it difficult to get approved for loans and other forms of credit in the future.

Conclusion

If you have bad credit, getting approved for a credit card can be a challenge. However, there are a number of credit cards available for people with bad credit. By using your credit card responsibly, you can rebuild your credit score and improve your financial situation.

Frequently Asked Questions

What are credit cards for bad credit?Credit cards for bad credit, often referred to as "subprime" credit cards, are specifically designed to cater to individuals with below-average credit scores or limited credit histories.

How can a credit card help improve my bad credit score?By consistently using the card for purchases, paying off the full balance on time, and keeping your credit utilization low, you demonstrate responsible credit behavior, which can positively impact your credit score over time.

Are interest rates higher for bad credit credit cards?Typically, credit cards for individuals with poor credit come with higher interest rates as they are deemed riskier by lenders. This underscores the importance of paying off balances in full each month.

What's the difference between secured and unsecured credit cards?Secured credit cards require a refundable security deposit which often sets your credit limit. In contrast, unsecured cards don't need a deposit but might have stricter approval requirements and higher fees.

Can I get approved for a bad credit credit card without a credit check?Some issuers offer no-credit-check cards, but these may come with higher fees and less favorable terms. It's essential to read the fine print before applying.

Are there annual fees associated with credit cards for poor credit?Many credit cards carry annual fees as part of their terms. It's crucial to be aware of these fees and compare options to ensure you're getting the best deal.

How can I transition to a standard credit card after using a bad credit card?With consistent responsible usage and timely payments, many issuers allow you to upgrade or will offer better terms after a set period. Additionally, as your credit score improves, you can apply for mainstream cards with better terms.

Do all credit cards for bad credit require a security deposit?No, only secured credit cards require a security deposit. There are unsecured credit cards designed for those with poor credit, though they might have higher fees or interest rates.

Will using a credit card for bad credit guarantee an improved credit score?While these cards provide the tools to improve your score, it's up to the individual to use the card responsibly. Consistent on-time payments and low credit utilization are key to boosting your credit score.

Can I increase my credit limit on a bad credit credit card?Many issuers review accounts periodically for credit limit increases, especially if the cardholder has demonstrated responsible usage. Some secured cards also offer a higher limit if you're willing to increase your deposit.