Destiny Card is a credit card issued by First Electronic Bank and serviced by Concora Credit, Inc. It is designed for people with fair or poor credit who are looking to build or rebuild their credit history. The card has a $0 annual fee and no security deposit required.

Benefits of Destiny Card

Here are the benefits of Destiny Card:

- $0 Annual Fee

- One of the biggest benefits of Destiny Card is that it has a $0 annual fee. This means that you won't have to pay any extra money to use the card, which is a great advantage over other credit cards that charge annual fees.

- No Security Deposit Required

- Another great benefit of Destiny Card is that it doesn't require a security deposit. This means that you won't have to put down any money upfront, which can be a major obstacle for many people who are trying to build or rebuild their credit.

- Reports Monthly Payments to the Three Major Credit Bureaus

- One of the most important things you can do to build or rebuild your credit is to make your payments on time each month. Destiny Card reports your monthly payments to the three major credit bureaus (Experian, Equifax, and TransUnion), which means that your on-time payments will be reflected in your credit report.

- 24/7 Online Account Access

- Destiny Card offers 24/7 online account access, so you can easily manage your account from anywhere in the world. You can check your balance, make payments, and view your transaction history online.

- Ability to Set Up Automatic Payments

- Destiny Card allows you to set up automatic payments, so you never have to worry about missing a payment and damaging your credit. You can choose to have your payments automatically deducted from your checking account each month.

- Chip Technology for Added Security

- Destiny Card is equipped with chip technology, which is a more secure way to make payments than traditional magnetic stripe cards. Chip technology makes it more difficult for fraudsters to steal your card information and make unauthorized charges.

- Pre-Qualify Without Impacting Your Credit Score

- Destiny Card allows you to pre-qualify without impacting your credit score. This means that you can see if you are likely to be approved for the card without having to go through the full application process.

Overall, Destiny Card is a great option for people with fair or poor credit who are looking to build or rebuild their credit history.

In addition to the benefits listed above, Destiny Card also offers a number of other features that make it a great choice for cardholders, including:

- No penalty APR

- Mastercard ID Theft Protection

- Mastercard Global Service

How to Apply

To apply for Destiny Card, you must be at least 18 years old and have a valid Social Security number. You can apply online or by calling Concora Credit at 1-888-866-8302.

Apply Online:

- Go to the Destiny Card website.

- Click on the "Apply Now" button.

- Enter your personal information, including your name, address, and Social Security number.

- Provide your income and employment history.

- Review your application and submit it.

Apply by Phone:

- Call Concora Credit at 1-888-866-8302.

- Tell the representative that you would like to apply.

- Provide your personal information, including your name, address, and Social Security number.

- Give your income and employment history.

- Review your application and submit it.

What to Expect After You Apply

Once you have submitted your application, Concora Credit will review it and make a decision about whether or not to approve you for Destiny Card. If you are approved, you will receive a welcome kit in the mail with your card information. You can then activate your card and start using it immediately. If you are not approved, you will receive a letter from Concora Credit explaining why. You may be able to reapply in the future if you improve your credit score.

Here are some tips for increasing your chances of getting approved:

- Make sure your credit report is accurate. You can get a free copy of your credit report from AnnualCreditReport.com.

- Pay your bills on time. Late payments can damage your credit score.

- Keep your credit utilization ratio low. This is the percentage of your available credit that you are using. A good rule of thumb is to keep your credit utilization ratio below 30%.

- Avoid opening too many new credit card accounts. Each time you open a new account, it appears on your credit report as a hard inquiry, which can temporarily lower your credit score.

- Consider becoming an authorized user on a friend or family member's credit card account. This can help you build credit history even if you don't have any credit of your own.

By following these tips, you can improve your chances of getting approved for Destiny Card and start on your path to building or rebuilding your credit.

How Destiny Card Can Help You Build or Rebuild Credit

Destiny Card is a great option for people with fair or poor credit who are looking to build or rebuild their credit history. Here are some of the ways that Destiny Card can help you:

- Reports your monthly payments to the three major credit bureaus. This is the most important factor in building or rebuilding your credit score. When you make your payments on time, Destiny Card reports them to Experian, Equifax, and TransUnion, which will help to improve your credit score over time.

- Has no annual fee or security deposit required. This means that you can start using Destiny Card right away without having to worry about any upfront costs.

- Offers a variety of credit-building tools. Destiny Card offers a number of tools to help you build or rebuild your credit, including:

- Credit Milestone Tracker: This tool allows you to track your progress as you build or rebuild your credit.

- Real-Time Credit Score Updates: Get real-time updates on your credit score as you make payments and use your card responsibly.

- CreditWise: This educational tool provides you with information on how to build and manage your credit.

- Is an unsecured credit card. This means that you don't have to put down a security deposit to get the card. This makes it a good option for people who may not have a lot of savings.

- Has a low minimum credit limit. This means that you can start small and gradually increase your credit limit as your credit score improves.

- Is accepted by millions of merchants worldwide. This means that you can use Destiny Card to make purchases almost anywhere.

- Offers 24/7 online account access. This means that you can easily manage your account from anywhere in the world.

- Provides chip technology for added security. This protects your card from fraud.

Here are some tips for using Destiny Card to build or rebuild your credit:

- Only charge what you can afford to pay off each month.

- Make your payments on time each month.

- Keep your credit utilization ratio low. This is the percentage of your available credit that you are using. A good rule of thumb is to keep your credit utilization ratio below 30%.

- Avoid using your card for cash advances. Cash advances have high interest rates and fees, which can quickly damage your credit.

- Monitor your credit report regularly. This will help you identify any errors or discrepancies that could be hurting your credit score.

By following these tips, you can use Destiny Card to build or rebuild your credit score and reach your financial goals.

Tips for Using Destiny Card Responsibly

Here are some tips for using Destiny Card responsibly:

- Only charge what you can afford to pay off each month. This is the most important rule of responsible credit card use. If you can't afford to pay off your balance in full each month, you'll be charged interest, which can quickly add up and make it difficult to get out of debt.

- Make your payments on time each month. This is another important factor in building or rebuilding your credit score. When you make your payments on time, you show lenders that you're a reliable borrower, which can help you qualify for lower interest rates and better terms on loans in the future.

- Keep your credit utilization ratio low. Your credit utilization ratio is the percentage of your available credit that you're using. Lenders like to see a credit utilization ratio of 30% or less. So, if you have a $1,000 credit limit, you should try to keep your balance at $300 or less.

- Avoid using your card for cash advances. Cash advances are typically subject to high interest rates and fees, so it's best to avoid them if you can. If you do need to take out a cash advance, be sure to pay it off as soon as possible to avoid paying a lot of interest.

- Monitor your credit report regularly. This will help you identify any errors or discrepancies that could be hurting your credit score. You can get a free copy of your credit report from AnnualCreditReport.com once per week.

- Set up automatic payments. This will help you avoid missing payments and damaging your credit score. You can set up automatic payments to be deducted from your checking account each month.

- Use your card to make everyday purchases. This will help you build up your credit history. However, be sure to only charge what you can afford to pay off each month.

- Use your card for travel and rewards. Destiny Card offers a variety of rewards programs, so you can earn rewards for using your card. This can be a great way to save money on travel, groceries, and other everyday expenses.

- Be aware of the fees. Destiny Card has a few fees, so be sure to read the terms and conditions carefully before you apply. Some of the fees include:

- Annual fee: $0

- Balance transfer fee: 3% of the transferred amount

- Cash advance fee: 5% of the amount advanced, plus $5

- Late payment fee: $35

- Don't lend your card to others. Lending your card to others can make you liable for any unauthorized charges.

- Report lost or stolen cards immediately. If you lose your card or it is stolen, report it to Concora Credit immediately. This will help to protect you from fraudulent charges.

- Keep your card information secure. Don't share your card number or PIN with anyone.

By following these tips, you can use Destiny Card responsibly and build or rebuild your credit score.

Additional Tips:

- Set a budget. This will help you track your income and expenses so you don't overspend.

- Make a plan to pay off your debt. This will help you stay motivated and on track.

- Don't open too many credit cards at once. This can damage your credit score.

- Avoid maxing out your credit cards. This can make it difficult to get approved for loans in the future.

- Be patient. It takes time to build or rebuild your credit score. Don't get discouraged if you don't see results immediately.

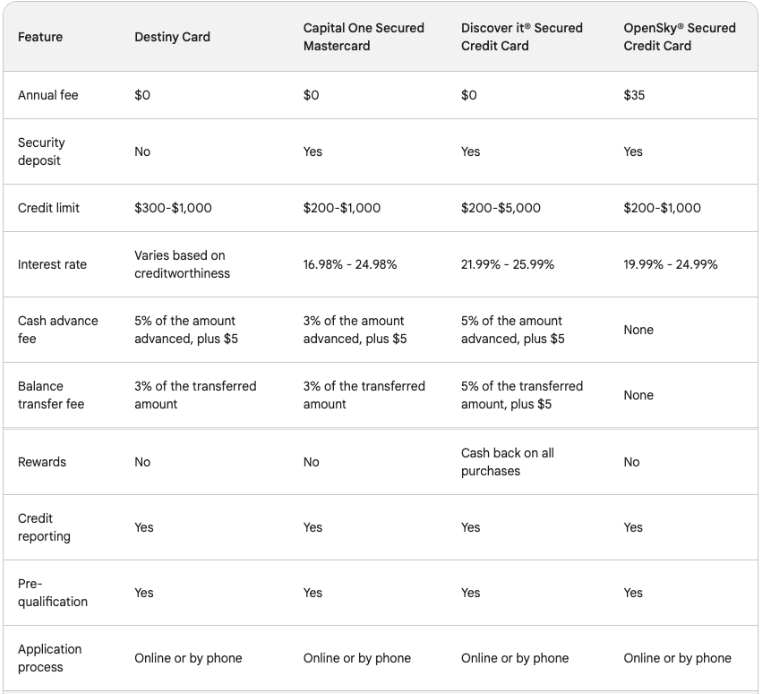

Alternatives to Destiny Card

Overall, Destiny Card, Capital One Secured Mastercard, Discover it® Secured Credit Card, and OpenSky® Secured Credit Card are all good options for people with fair or poor credit who are looking to build or rebuild their credit history. The best card for you will depend on your individual needs and circumstances.

Here are some additional factors to consider when choosing a credit card:

- Your credit score: The lower your credit score, the more limited your options will be. You may want to consider a card with a lower credit limit or a higher interest rate.

- Your goals: If you're looking to build your credit history quickly, you'll want to choose a card that reports your payments to the credit bureaus. If you're looking to earn rewards, you'll want to choose a card that offers rewards that you'll actually use.

- Your fees: Be sure to read the terms and conditions carefully to understand all of the fees associated with the card.

By taking the time to compare your options, you can find the best credit card for your needs.

Conclusion

Destiny Card is a good option for people with fair or poor credit who are looking to build or rebuild their credit history. The card has a $0 annual fee, no security deposit required, and reports your monthly payments to the three major credit bureaus.

Frequently Asked Questions

What is Destiny Card?Destiny Card is a credit card issued by First Electronic Bank and serviced by Concora Credit, Inc. It is designed for people with fair or poor credit who are looking to build or rebuild their credit history. The card has a $0 annual fee and no security deposit required.

Who is eligible for Destiny Card?To be eligible for Destiny Card, you must be at least 18 years old and have a valid Social Security number. You must also have a fair or poor credit score.

How do I apply for Destiny Card?You can apply for Destiny Card online or by calling Concora Credit at 1-888-866-8302. The application process is quick and easy.

How can I use Destiny Card to build or rebuild my credit?The best way to use Destiny Card to build or rebuild your credit is to make your payments on time each month. You should also keep your credit utilization ratio low. This is the percentage of your available credit that you are using. A good rule of thumb is to keep your credit utilization ratio below 30%.

What are the fees for Destiny Card?Destiny Card has a few fees, including:

• Balance transfer fee: 3% of the transferred amount

• Cash advance fee: 5% of the amount advanced, plus $5

• Late payment fee: $35

How do I manage my Destiny Card account?You can manage your Destiny Card account online or by calling Concora Credit at 1-888-866-8302. You can check your balance, make payments, and view your transaction history online.

What should I do if my Destiny Card is lost or stolen?If your Destiny Card is lost or stolen, you should report it to Concora Credit immediately. This will help to protect you from unauthorized charges.

What is the customer service number for Destiny Card?The customer service number for Destiny Card is 1-888-866-8302.

Where can I learn more about Destiny Card?ou can learn more about Destiny Card by visiting the card's website at www.destinycard.com.