FHA 203(k) loan is a type of mortgage that allows homebuyers and homeowners to finance the purchase or refinance of a home and the cost of renovations into a single loan. This type of loan is insured by the Federal Housing Administration (FHA), which means that lenders may be more willing to offer it to borrowers with lower credit scores or higher debt-to-income ratios than they would for a conventional loan.

How does it work?

When you apply for an FHA 203(k) loan, you will need to provide your lender with a detailed plan of the renovations you plan to make. The lender will then have the property appraised to determine the current value and the estimated value after the renovations are complete. The loan amount will be based on the lesser of the two values.

Once you have been approved for the loan, the proceeds will be placed in an escrow account. As the renovations are completed, the lender will release funds from the escrow account to the contractor. This helps to ensure that the renovations are completed on time and within budget.

Types of FHA 203(k) loans

There are two types of FHA 203(k) loans:

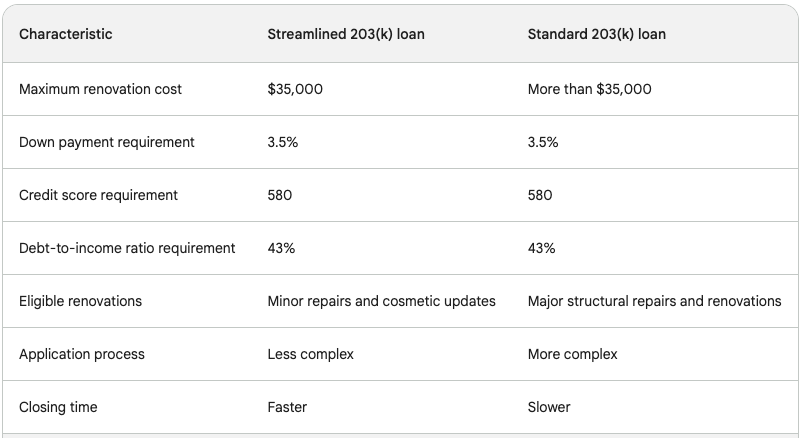

- Streamlined 203(k) loan: This type of loan is for smaller renovations, costing up to $35,000. Streamlined 203(k) loans are less complex to apply for and close on than standard 203(k) loans.

- Standard 203(k) loan: This type of loan is for larger renovations, costing more than $35,000. Standard 203(k) loans require a more detailed application process and may take longer to close on.

Here is a table that compares the two types of FHA 203(k) loans:

Which type of FHA 203(k) loan is right for me?

The best type of FHA 203(k) loan for you will depend on the scope of your renovations and your financial situation. If you are planning on making minor repairs or cosmetic updates, a streamlined 203(k) loan may be a good option for you. If you are planning on making major structural repairs or renovations, a standard 203(k) loan may be a better choice.

It is important to note that both streamlined 203(k) loans and standard 203(k) loans have the same basic eligibility requirements, including a minimum credit score of 580 and a maximum debt-to-income ratio of 43%.

How to choose a lender for an FHA 203(k) loan

When choosing a lender for an FHA 203(k) loan, it is important to compare rates and fees from different lenders. You should also make sure that the lender you choose is experienced in processing and closing FHA 203(k) loans.

You can ask your friends, family, or real estate agent for recommendations for FHA 203(k) lenders. You can also search for FHA-approved lenders on the FHA website.

Benefits of FHA 203(k) loans

FHA 203(k) loans offer a number of benefits, including:

- Low down payment requirement: FHA 203(k) loans allow borrowers to make a down payment as low as 3.5%. This can be a major benefit for first-time homebuyers or borrowers with limited savings.

- Flexible credit requirements: FHA 203(k) loans are more accessible to borrowers with lower credit scores than conventional loans. This is because the FHA insures these loans, which makes them less risky for lenders.

- Roll-in renovation costs: FHA 203(k) loans allow borrowers to roll the cost of renovations into their mortgage. This makes it more affordable to finance repairs and updates.

- Improve the value of your home: Renovations can help to increase the value of your home, which can be beneficial if you sell in the future.

- One loan for both purchase and renovations: FHA 203(k) loans allow borrowers to finance the purchase or refinance of a home and the cost of renovations into a single loan. This can simplify the process and make it easier to manage your finances.

In addition to these benefits, FHA 203(k) loans can also be used to finance a wide variety of renovations, including:

- Minor repairs, such as fixing leaky faucets or painting the walls

- Major structural repairs, such as replacing the roof or foundation

- Cosmetic updates, such as remodeling the kitchen or bathroom

- Accessibility modifications, such as installing a ramp or widening doorways

Overall, FHA 203(k) loans can be a great option for homebuyers and homeowners who want to finance the purchase or refinance of a home and the cost of renovations into a single loan. These loans offer a number of benefits, including low down payment requirements, flexible credit requirements, and the ability to roll-in renovation costs.

Who is eligible for an FHA 203(k) loan?

To be eligible for an FHA 203(k) loan, you must meet the following requirements:

- Have a good credit score: The minimum credit score for an FHA 203(k) loan is 580. However, if you have a credit score of 500-579, you may still be eligible if you can make a down payment of at least 10%.

- Have a low debt-to-income ratio: The maximum debt-to-income ratio for an FHA 203(k) loan is 43%. This means that your total monthly debt payments cannot exceed 43% of your gross monthly income.

- Make a down payment of at least 3.5%: However, if you have a credit score of 500-579, you may need to make a down payment of at least 10%.

- Purchase or refinance a property that is eligible for an FHA loan: Not all properties are eligible for FHA financing. You can check the FHA website to see if the property you are interested in is eligible.

In addition to these general requirements, there are also some specific requirements for the renovations that you can finance with an FHA 203(k) loan. For example, the renovations must be necessary to make the property habitable or to improve the health or safety of the occupants. The renovations must also be completed by a qualified contractor.

If you are interested in applying for an FHA 203(k) loan, you should contact a lender that is approved to offer FHA loans. The lender can help you to determine if you are eligible for this type of loan and can assist you with the application process.

How to apply for an FHA 203(k) loan

To apply for an FHA 203(k) loan, you will need to follow these steps:

- Find a lender that is approved to offer FHA loans. You can use the FHA's website to find a list of approved lenders.

- Get pre-approved for a loan. This will give you an estimate of how much money you can borrow and what your monthly payments will be.

- Find a property that is eligible for an FHA 203(k) loan. Not all properties are eligible, so you will need to check with the FHA or your lender.

- Have the property inspected by a qualified inspector. This is required by the FHA to ensure that the property is in good condition and that the renovations are necessary.

- Get a detailed estimate of the renovation costs from a qualified contractor. This estimate will be used by the lender to determine the loan amount.

- Submit a loan application to the lender. You will need to provide the lender with your pre-approval letter, the property inspection report, the renovation estimate, and other required documentation.

- Once the loan is approved, close on the property and begin the renovations.

The renovation process can take several months to complete, so it is important to be patient and to work closely with your contractor.

Here are some additional tips for applying for an FHA 203(k) loan:

- Be prepared to provide the lender with a lot of documentation. In addition to your pre-approval letter, the property inspection report, and the renovation estimate, you will also need to provide the lender with your tax returns, W-2 statements, and other financial documents.

- Be prepared to answer questions about your financial situation and your plans for the renovations. The lender will want to make sure that you can afford the loan payments and that the renovations will be completed on time and within budget.

- Be flexible. The lender may ask you to make changes to your renovation plans or to provide additional documentation. Be willing to work with the lender to get your loan approved.

If you have any questions about the FHA 203(k) loan process, be sure to contact your lender or a housing counselor.

Conclusion

An FHA 203(k) loan can be a great option for homebuyers and homeowners who want to finance the purchase or refinance of a home and the cost of renovations into a single loan. This type of loan is especially beneficial for borrowers with lower credit scores or higher debt-to-income ratios.

If you are considering an FHA 203(k) loan, be sure to shop around and compare rates from different lenders. You should also work with a qualified contractor who is experienced in completing FHA 203(k) renovations.

Frequently Asked Questions

What is an FHA 203(k) loan and how does it differ from a standard FHA loan?An FHA 203(k) loan is a specialized home improvement mortgage backed by the Federal Housing Administration, designed specifically for renovations and repairs. Unlike a standard FHA loan, which is primarily for purchasing homes, the 203(k) allows borrowers to finance both the purchase of a property and the cost of its rehabilitation.

Who is eligible for an FHA 203(k) renovation loan?Typically, homebuyers and homeowners who want to rehabilitate a home can qualify for an FHA 203(k) loan. The requirements are similar to standard FHA loans, including a low down payment and flexible credit score guidelines.

What types of properties qualify for the FHA 203(k) program?This loan program is available for 1-4 unit residential properties, including single-family homes, duplexes, triplexes, and quadplexes. Both existing homes and homes under construction can qualify.

What are the maximum loan amounts for FHA 203(k) loans?The maximum amount you can borrow is typically based on the home's projected value after improvements, but there are limits that vary by county and state. It's important to check with local FHA offices or lenders for specific figures.

Can I use the FHA 203(k) loan for any renovation project?The loan can be used for a wide range of renovations, from structural alterations to aesthetic improvements. However, the repairs or improvements must meet FHA standards and must be permanently affixed to the property.

Do I need to hire professionals for my FHA 203(k) renovation?Yes, projects financed by a 203(k) loan typically require the use of licensed and insured contractors. This ensures the work meets FHA guidelines and standards.

How long do I have to complete the renovations with an FHA 203(k) loan?After loan approval and disbursement, homeowners usually have a timeline of six months to complete all the necessary repair work and renovations.

Are there different types of FHA 203(k) loans?Yes, there are two primary types: the Limited 203(k) which is for smaller projects without structural changes, and the Standard 203(k) for larger, more comprehensive projects.

How does the disbursement of funds work for 203(k) loans?Funds for renovation are generally placed in an escrow account and disbursed as work is completed. Inspections are typically required before funds are released to contractors.

Where can I find an FHA-approved lender for a 203(k) loan?Many lenders who work with standard FHA loans also offer 203(k) loans. It's advisable to check the U.S. Department of Housing and Urban Development's lender list or consult with a local mortgage broker.