Loans for bad credit can be a lifeline for those who need financial assistance but have a less-than-stellar credit history. While obtaining a loan with bad credit can be challenging, it is not impossible. By understanding the different types of loans available, comparing offers from multiple lenders, and being aware of the potential risks, borrowers can make informed decisions about whether or not a loan is right for them.

Understanding the different types of loans for bad credit

When it comes to loans for bad credit, there are a few key types to be aware of:

- Personal loans: Personal loans are unsecured loans that can be used for a variety of purposes, such as consolidating debt, paying for unexpected expenses, or making home improvements. Lenders that specialize in bad credit loans typically offer higher interest rates than those offered to borrowers with good credit.

- Payday loans: Payday loans are short-term loans that are typically due on the borrower's next payday. These loans are often associated with high fees and interest rates.

- Title loans: Title loans are secured loans that use the borrower's vehicle title as collateral. These loans are often easier to qualify for than unsecured loans, but they can be risky if the borrower is unable to repay the loan.

- Credit builder loans: Credit builder loans are designed to help borrowers establish or improve their credit history. These loans are typically offered by credit unions and community banks.

- Co-signed loans: Co-signed loans are loans that are taken out by two borrowers. The co-signer agrees to be responsible for the loan if the primary borrower is unable to repay it.

- Government-backed loans: Government-backed loans are loans that are insured or guaranteed by the government. These loans can be a good option for borrowers with bad credit because they are typically offered with lower interest rates and more flexible repayment terms.

Each type of loan has its own advantages and disadvantages. It is important to carefully consider the terms and conditions of each loan before choosing one.

Evaluating the pros and cons

Pros of bad credit loans

- Access to credit: Bad credit loans can provide borrowers with access to credit that they would not otherwise have. This can be helpful for those who need to consolidate debt, pay for unexpected expenses, or make home improvements.

- Opportunity to improve credit score: Some types of bad credit loans, such as credit builder loans, can help borrowers improve their credit score. This can make it easier to qualify for more favorable loan terms in the future.

- Flexibility: Bad credit loans can offer borrowers flexibility in terms of repayment terms. This can be helpful for those who have difficulty making large monthly payments.

Cons of bad credit loans

- High interest rates: Bad credit loans typically come with high interest rates. This can make the total cost of the loan significantly higher than the amount borrowed.

- Fees: In addition to interest, borrowers may also be charged fees, such as origination fees, late payment fees, and prepayment penalties. These fees can add to the overall cost of the loan.

- Risk of default: Borrowers who are unable to repay their bad credit loans may be at risk of default. This can damage their credit score and make it more difficult to obtain loans in the future.

The decision of whether or not to take out a bad credit loan is a personal one. Borrowers should carefully weigh the pros and cons of these loans before making a decision.

Comparing interest rates, fees, and loan terms

When comparing loans for bad credit, it is important to pay attention to the following factors:

- Interest rate: The interest rate is the cost of borrowing money. Bad credit borrowers will typically be offered higher interest rates than borrowers with good credit.

- Fees: In addition to interest, borrowers may also be charged fees, such as origination fees, late payment fees, and prepayment penalties.

- Loan term: The loan term is the length of time the borrower has to repay the loan. Shorter loan terms will typically result in higher monthly payments, but borrowers will pay less interest over the life of the loan.

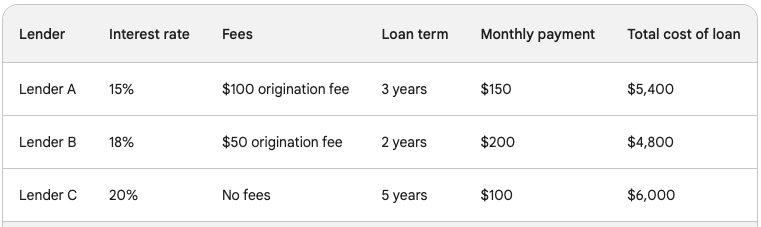

Here is an example of how to compare loan offers:

In this example, Lender B is offering the best deal because they have the lowest total cost of loan. However, it is important to note that the best deal for one borrower may not be the best deal for another borrower. Borrowers should carefully consider their own individual needs and circumstances when choosing a loan.

Enhancing your chances of loan approval with bad credit

Having bad credit can make it challenging to obtain a loan. However, there are a number of things borrowers can do to enhance their chances of loan approval:

- Check your credit report and dispute any errors. A single error on your credit report can have a significant impact on your credit score. By disputing any errors, you can ensure that your credit report is accurate.

- Make all of your payments on time. Payment history is the most important factor in your credit score. By making all of your payments on time, you can demonstrate to lenders that you are a responsible borrower.

- Reduce your debt-to-income ratio. Your debt-to-income ratio is the amount of debt you have compared to your income. A high debt-to-income ratio can make it appear to lenders that you are overextended. By reducing your debt, you can improve your debt-to-income ratio.

- Get a co-signer. A co-signer is someone who agrees to be responsible for the loan if you are unable to repay it. Having a co-signer with good credit can improve your chances of loan approval.

- Apply for a secured loan. A secured loan is a loan that is backed by collateral, such as a car or home. Secured loans are typically easier to qualify for than unsecured loans.

- Apply for a credit builder loan. A credit builder loan is a loan that is designed to help borrowers establish or improve their credit history. Credit builder loans are typically offered by credit unions and community banks.

- Pre-qualify for a loan. Pre-qualifying for a loan can give you an idea of how much you can borrow and what your monthly payments will be. Pre-qualifying for a loan will not impact your credit score.

- Shop around for the best interest rate. Different lenders will offer different interest rates on loans for bad credit. By shopping around, you can find the lender that is offering the best interest rate.

By following these tips, borrowers can enhance their chances of loan approval with bad credit.

It is also important to remember that building good credit takes time. If you are working on improving your credit, it is important to be patient. By making responsible financial decisions, you can gradually improve your credit score and qualify for better loan terms in the future.

Strategies for managing bad credit loans

Managing bad credit loans can be challenging, but it is possible to do so effectively. Here are a few strategies to help you manage your bad credit loans:

- Create a budget and stick to it. This will help you track your income and expenses, and ensure that you are able to make your loan payments on time.

- Make more than the minimum payment. If you can afford to, make more than the minimum payment on your loans. This will help you pay off your debt faster and save money on interest.

- Consolidate your debt. If you have multiple loans, you may be able to consolidate them into a single loan with a lower interest rate. This can make your monthly payments more manageable.

- Refinance your loans. If your credit score has improved, you may be able to refinance your loans at a lower interest rate. This can save you money on interest over the life of the loan.

- Contact your lender if you are having difficulty making payments. If you are having difficulty making your loan payments, contact your lender as soon as possible. They may be able to work with you to create a payment plan that is more affordable.

- Avoid taking out additional loans. If you are struggling to manage your existing loans, it is important to avoid taking out additional loans. This will only make your debt situation worse.

- Get credit counseling. If you are struggling to manage your debt, you may want to consider getting credit counseling. A credit counselor can help you create a budget, develop a plan to pay off your debt, and negotiate with your creditors.

By following these strategies, you can manage your bad credit loans and improve your financial situation.

It is also important to remember that building good credit takes time. If you are working on improving your credit, it is important to be patient. By making responsible financial decisions, you can gradually improve your credit score and qualify for better loan terms in the future.

Building a positive credit history for future borrowing

Having a good credit history is essential for obtaining loans, credit cards, and other forms of financing. A good credit history shows lenders that you are a responsible borrower and that you are likely to repay your debts on time.

There are a number of things you can do to build a positive credit history:

- Get a credit card. A credit card is a great way to start building a credit history. Be sure to use your credit card responsibly and make all of your payments on time.

- Become an authorized user on someone else's credit card. If you have a friend or family member with good credit, ask them if they would be willing to add you as an authorized user on their credit card. This will allow you to piggyback on their good credit history.

- Take out a secured loan. A secured loan is a loan that is backed by collateral, such as a car or home. Secured loans are typically easier to qualify for than unsecured loans.

- Make on-time payments on all of your bills. Your payment history is the most important factor in your credit score. By making all of your payments on time, you can demonstrate to lenders that you are a responsible borrower.

- Keep your credit utilization low. Your credit utilization is the amount of credit you are using compared to the amount of credit you have available. A high credit utilization can damage your credit score. Try to keep your credit utilization below 30%.

- Dispute any errors on your credit report. If you find any errors on your credit report, be sure to dispute them immediately. Errors on your credit report can damage your credit score.

- Be patient. Building a good credit history takes time. Don't expect to see a dramatic improvement in your credit score overnight. By following these tips, you can gradually improve your credit score and build a positive credit history.

Having a good credit history can save you money on interest and fees. It can also make it easier to qualify for loans and other forms of financing. By taking steps to build a positive credit history, you can improve your financial future.

Conclusion

Loans for bad credit can be a valuable tool for those who need financial assistance. However, it is important to be aware of the potential risks associated with these loans. By carefully considering the options available and making informed decisions, borrowers can minimize the risks and maximize the benefits of obtaining a loan for bad credit.

Frequently Asked Questions

What is a bad credit loan?A bad credit loan is a type of personal loan offered to borrowers with weak, bad, or no credit. These loans can help individuals rebuild their credit score and financial stability.

How can I qualify for a loan with bad credit?Qualifying criteria vary by lender, but generally, lenders look at factors like income, employment stability, and other assets, not just your credit score.

Which lenders offer bad credit loans?Numerous lenders specialize in offering loans to those with bad credit, including online lenders, credit unions, and some traditional banks.

Are bad credit loans safe?While there are legitimate lenders offering bad credit loans, it's essential to be cautious and research each lender, as scams are prevalent in this market. Always check reviews and regulatory bodies for credentials.

How can bad credit loans improve my credit score?By consistently making on-time payments on a bad credit loan, you can demonstrate responsible credit behavior, which can help boost your credit score over time.

Are interest rates higher for bad credit loans?Yes, interest rates are typically higher for bad credit loans due to the increased risk lenders assume when lending to individuals with a history of missed payments or defaults.

Can I get a bad credit loan without collateral?Yes, there are both secured (requiring collateral) and unsecured (no collateral required) bad credit loans available. However, unsecured loans may have higher interest rates.

How quickly can I get funds after being approved for a bad credit loan?The disbursement time varies by lender. Online lenders may transfer funds as quickly as the next business day, while traditional banks or credit unions might take a few days.

Is there a limit to how much I can borrow with a bad credit loan?Loan amounts can vary widely based on the lender and your financial situation, but it's common for bad credit loans to have lower maximum amounts compared to traditional loans.

Can I get a bad credit loan if I've declared bankruptcy in the past?Yes, some lenders may still consider you for a loan even with a bankruptcy on your record, though it can be more challenging and might come with higher interest rates or stricter terms.