Loans for rent can be a lifesaver for people who are struggling to make their monthly payments. Whether you've lost your job, had an unexpected expense, or are simply behind on your bills, a rent loan can help you get back on your feet.

However, it's important to be aware of the risks involved before taking out a loan for rent. Rent loans typically have high interest rates and fees, and if you're unable to make your payments, you could face eviction.

That's why it's important to only consider a rent loan as a last resort. If you have other options available, such as borrowing money from friends or family, or applying for government assistance, you should explore those first.

Types of Rent Loans: Which One Is Right for You?

There are a few different types of rent loans available, each with its own advantages and disadvantages. Here is a brief overview of the most common types:

- Personal loans: Personal loans are typically unsecured loans, meaning you don't need to put up any collateral to qualify. This makes them a good option for borrowers with bad credit. However, personal loans typically have higher interest rates than secured loans.

- Title loans: Title loans are secured loans that use your car title as collateral. This means that if you default on the loan, the lender can repossess your car. Title loans typically have very high interest rates and fees, so they should only be considered as a last resort.

- Payday loans: Payday loans are short-term loans that typically have very high interest rates and fees. Payday loans should only be used for emergencies, and you should be prepared to repay the loan in full on your next payday.

- Rent-to-own agreements: Rent-to-own agreements allow you to rent a property with the option to buy it later. These agreements typically involve high interest rates and fees, and you may end up paying more for the property than if you had purchased it outright.

- Government assistance programs: There are a number of government assistance programs that can help with rent payments. These programs typically have strict eligibility requirements, but they can be a great option for low-income borrowers.

Which type of rent loan is right for you depends on your individual circumstances. If you have good credit and a steady income, you may be able to qualify for a personal loan with a lower interest rate. If you have bad credit or a low income, you may need to consider a secured loan or government assistance program.

Here are some factors to consider when choosing a rent loan:

- Interest rate: The interest rate is the cost of borrowing money. A lower interest rate means you'll pay less money in interest over the life of the loan.

- Fees: Some lenders charge fees for rent loans, such as origination fees and late payment fees. Be sure to factor these fees into your decision when comparing different lenders.

- Term of the loan: The term of the loan is the length of time you have to repay the loan. A shorter term typically means higher monthly payments, but it can also mean a lower interest rate.

- Collateral: Some rent loans require collateral, such as your car title or a bank account. If you're unable to provide collateral, you may have fewer loan options available.

It's important to shop around and compare different lenders before choosing a rent loan. Be sure to read the terms and conditions carefully before signing any paperwork.

How to Get a Loan Even With Bad Credit

If you have bad credit, it may be more difficult to qualify for a rent loan. However, there are still a few lenders who offer loans to borrowers with poor credit history.

Here are a few tips on how to get a rent loan with bad credit:

- Shop around and compare different lenders. Not all lenders are created equal. Some lenders are more willing to work with borrowers with bad credit than others.

- Be prepared to provide documentation of your income and expenses. This will help the lender assess your ability to repay the loan.

- Consider applying for a secured loan. Secured loans require collateral, such as your car title or a bank account. This can make it easier to qualify for a loan, even with bad credit.

- Ask a cosigner. A cosigner is someone who agrees to be responsible for the loan if you default. Having a cosigner can improve your chances of qualifying for a loan.

It's important to remember that rent loans typically have high interest rates and fees. Even if you qualify for a loan with bad credit, you'll likely end up paying more money in interest over the life of the loan.

If you're considering taking out a rent loan, be sure to weigh the risks and benefits carefully. Make sure you understand the terms of the loan and that you can afford to make the payments.

Here are some additional tips for getting a rent loan with bad credit:

- Make a budget and show the lender that you have a plan to repay the loan.

- Get pre-approved for a loan before you start shopping around. This will give you an idea of how much you can borrow and what your interest rate will be.

- Be prepared to negotiate with the lender. Many lenders are willing to work with borrowers with bad credit to get them approved for a loan.

If you're struggling to make your rent payments, there are other options available to you. You may be able to get help from your landlord, government assistance programs, or nonprofit organizations.

How to Compare Rent Loan Interest Rates and Fees

When comparing rent loan interest rates and fees, there are a few things to keep in mind:

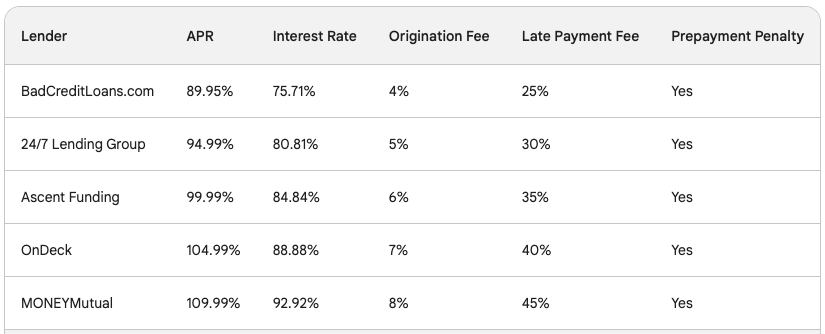

- Annual percentage rate (APR): The APR is the total cost of borrowing money, expressed as a percentage. It includes the interest rate and any other fees associated with the loan.

- Interest rate: The interest rate is the cost of borrowing money. It is typically expressed as a percentage of the loan amount.

- Origination fee: An origination fee is a fee that the lender charges for processing the loan application.

- Late payment fee: A late payment fee is a fee that the lender charges if the borrower makes a payment late.

- Prepayment penalty: A prepayment penalty is a fee that the lender charges if the borrower pays off the loan early.

To compare rent loan interest rates and fees, you need to get quotes from multiple lenders.

Once you have quotes from multiple lenders, you can compare the APR, interest rate, origination fee, late payment fee, and prepayment penalty. Be sure to factor all of these fees into your decision when choosing a rent loan.

Here are a few tips for comparing rent loan interest rates and fees:

- Get quotes from multiple lenders. This will give you a better idea of what interest rates and fees are available.

- Be sure to compare the APR. The APR is the most accurate way to compare the total cost of borrowing money.

- Factor in all of the fees. Don't just look at the interest rate. Consider the origination fee, late payment fee, and prepayment penalty as well.

- Read the terms and conditions carefully. Make sure you understand all of the terms of the loan before you sign any paperwork.

The Pros and Cons of Rent Loans

Pros of rent loans:

- Quick access to cash: Rent loans can be a quick and easy way to get cash to cover your rent payment.

- Flexible repayment terms: Rent loans typically have flexible repayment terms, which can be helpful if you're struggling to make your rent payments.

- No collateral required: Some rent loans don't require collateral, which can be helpful if you don't have any assets to secure the loan.

- Variety of lenders available: There are a variety of lenders that offer rent loans, so you can compare interest rates and fees to find the best deal.

Cons of rent loans:

- High interest rates and fees: Rent loans typically have high interest rates and fees. This means that you'll end up paying more money in the long run.

- Risk of default: If you're unable to make your rent loan payments, you could face eviction.

- Negative impact on credit score: Taking out a rent loan can have a negative impact on your credit score.

- Other options may be available: There may be other options available to you, such as government assistance programs or help from your landlord.

Overall, rent loans should be considered a last resort. There are other options available that may be a better fit for your financial situation.

If you do decide to take out a rent loan, be sure to compare interest rates and fees from multiple lenders. Be prepared to make regular payments on time and avoid late payments.

How to Avoid Rent Loan Scams

Rent loan scams are becoming increasingly common, and it's important to be aware of the warning signs so you can avoid becoming a victim.

Here are a few tips on how to avoid rent loan scams:

- Be wary of lenders who promise quick and easy approval. Legitimate lenders will typically require you to provide documentation of your income and expenses before approving a loan.

- Be suspicious of lenders who charge high upfront fees. Legitimate lenders may charge origination fees, but these fees should be relatively low.

- Be wary of lenders who pressure you to sign a loan agreement without reading it carefully. Take your time to read the terms and conditions of the loan agreement before you sign anything.

- Be suspicious of lenders who ask for your personal information, such as your Social Security number or bank account number, over the phone or through email. Legitimate lenders will only ask for this information after you have been approved for a loan.

Here are some specific red flags to watch out for:

- Lenders who promise to pay your rent directly to your landlord. This is a red flag because it means that the lender is not actually giving you a loan. Instead, they are simply paying your rent for you and then charging you a fee for the service.

- Lenders who require you to pay a fee to get pre-approved for a loan. This is a red flag because legitimate lenders do not charge pre-approval fees.

- Lenders who promise to help you improve your credit score. This is a red flag because rent loans typically have a negative impact on your credit score.

- Lenders who pressure you to sign a loan agreement quickly. This is a red flag because you should always have time to read and understand the terms of a loan agreement before you sign it.

If you are contacted by a lender who you suspect is a scam, you should report them to the Federal Trade Commission (FTC). You can also file a complaint with your state attorney general's office.

If you have already been scammed, you should contact your local law enforcement agency. You may also be able to file a civil lawsuit against the lender.

In conclusion, loans for rent serve as a valuable resource for individuals navigating the challenges of rental expenses. When used judiciously, these loans can offer a convenient and timely solution to maintain housing stability. By staying informed about the terms, responsibly managing the borrowing process, and exploring options from reputable lenders, tenants can confidently address immediate rental needs while safeguarding their long-term financial well-being.

Frequently Asked Questions

What are loans for rent, and how do they work?Loans for rent are financial products designed to assist individuals in covering their rental expenses. Typically, these loans provide a lump sum amount that tenants can use to pay their rent, and repayment is made through agreed-upon terms with the lender.

Who qualifies for loans for rent?Eligibility criteria can vary among lenders, but generally, individuals with a steady income and a reasonable credit history are more likely to qualify for loans for rent. Some lenders may have specific requirements, so it's essential to check with each provider.

How quickly can I access funds with a loan for rent?Many lenders offer quick approval processes for loans for rent, allowing eligible applicants to access funds within a few days. Online lenders, in particular, may provide a faster turnaround compared to traditional financial institutions.

Are there specific uses for the funds from a loan for rent?The primary purpose of loans for rent is to cover rental expenses. However, once approved, tenants have the flexibility to use the funds as needed to address immediate housing-related financial challenges.

What is the typical repayment period for loans for rent?Repayment periods vary, but they often range from a few months to a couple of years. The duration depends on the terms agreed upon with the lender and the amount borrowed.

Are there any risks associated with taking out a loan for rent?Like any financial product, there are risks involved. High-interest rates, potential fees, and the risk of defaulting on repayments are factors to consider. It's crucial to read and understand the terms before committing to a loan.

Can I get a loan for rent with bad credit?Some lenders specialize in providing loans for rent to individuals with less-than-perfect credit. While approval may be possible, it's essential to be aware that interest rates might be higher for those with lower credit scores.

Do I need collateral to secure a loan for rent?In most cases, loans for rent are unsecured, meaning they do not require collateral. However, the terms may vary between lenders, so it's advisable to check the specific requirements of each loan provider.

Can I prepay or pay off my loan for rent early?Many lenders allow borrowers to prepay or pay off their loans early without incurring additional fees. It's recommended to confirm this option with the lender before taking out the loan.

What steps can I take if I'm struggling to repay my loan for rent?If faced with difficulties in repaying the loan, it's crucial to communicate with the lender as soon as possible. Some lenders may offer flexibility in restructuring repayment plans or provide assistance during financial hardships.