Merchant cash advance Blursoft is revolutionizing the way businesses access quick and flexible financing solutions. In today's fast-paced business environment, having access to immediate capital can be a game-changer, and Blursoft is at the forefront of providing a seamless and efficient funding option for businesses of all sizes.

What is a Merchant Cash Advance?

A merchant cash advance (MCA) is not a traditional loan. Instead, it's a cash advance provided to a business in exchange for a percentage of its daily credit card sales and debit card sales, typically via card terminals. MCAs are designed to offer businesses a quick infusion of working capital to address immediate financial needs, such as inventory purchase, equipment upgrades, or marketing campaigns.

MCA Blursoft: The Advantages

Blursoft, a leading provider of merchant cash advances, sets itself apart with several key advantages:

- Speedy Access to Funds: Blursoft understands the urgency businesses often face. Their streamlined application process and quick approval system ensure that funds can be in your business account within days, if not hours. This agility is especially valuable when opportunities or emergencies arise that require immediate financial resources.

- No Collateral Required: Unlike traditional loans that often require collateral, merchant cash advances are unsecured. Blursoft's MCA program allows businesses to secure financing without risking their assets or personal property.

- Flexible Repayment: Blursoft takes a unique approach to repayment. Instead of fixed monthly payments, they collect a small percentage of your daily credit card and debit card sales. This flexibility means that your repayments align with your cash flow, making it less burdensome during slower periods and more manageable during prosperous times.

- Credit Score Flexibility: Traditional lenders often rely heavily on your credit score to determine your eligibility for financing. Blursoft places less emphasis on your credit history and focuses more on your daily card sales. This approach opens doors for businesses with less-than-perfect credit.

- No Restrictions on Usage: Once you receive the funds, you have the freedom to use them as you see fit, whether for marketing, inventory, equipment, or any other business need. Blursoft doesn't impose restrictions on how you deploy the financing.

How to Get a Merchant Cash Advance with Blursoft

- Check your eligibility. To qualify for a merchant cash advance with Blursoft, you must have been in business for at least four months, generate at least $10,000 in monthly sales, and have a credit score of 500 or above.

- Complete an online application. You can complete an online application on Blursoft's website. The application will ask for basic information about your business, such as your business name, contact information, and monthly revenue.

- Submit your bank statements. Blursoft will need to review your bank statements to verify your monthly revenue. You can submit your bank statements online or by fax.

- Get approved. Blursoft will review your application and bank statements and let you know if you are approved for a merchant cash advance. If you are approved, you will be able to access your funds within 24 hours.

- Repay your advance. You will repay your merchant cash advance over a period of 4 to 18 months. The repayment amount will be based on your monthly sales.

Here are some additional tips for getting a merchant cash advance with Blursoft:

- Shop around. Compare rates and terms from different merchant cash advance providers before you choose a lender.

- Understand the fees. Merchant cash advances typically come with fees, such as origination fees and transaction fees. Make sure you understand all of the fees before you agree to an advance.

- Be prepared to provide documentation. Blursoft may require you to provide documentation to support your application, such as business tax returns and financial statements.

- Have a plan for how you will use the funds. Make sure you have a clear plan for how you will use the funds from your merchant cash advance. This will help you ensure that you are using the advance to grow your business.

The Benefits of Using Blursoft for Your Merchant Cash Advance

Blursoft is a merchant cash advance provider that offers a variety of benefits to businesses, including:

- Fast and easy application process: Blursoft's online application process is quick and easy to complete. You can submit your application and be approved within 24 hours.

- No collateral required: Blursoft does not require collateral to approve your merchant cash advance. This means that you can get the funding you need even if you don't have any assets to put up as security.

- Flexible repayment terms: Blursoft offers flexible repayment terms that are based on your monthly sales. This means that you can repay your advance without putting a strain on your cash flow.

- Transparent pricing: Blursoft's pricing is transparent and easy to understand. You will know exactly how much your advance will cost before you agree to it.

- Dedicated customer service: Blursoft has a dedicated team of customer service representatives who are available to answer your questions and help you with your advance.

Here are some specific examples of how Blursoft has helped businesses:

- A restaurant was able to purchase new kitchen equipment with its Blursoft merchant cash advance. This helped the restaurant to improve its efficiency and increase its sales.

- A retail store was able to expand its inventory with its Blursoft merchant cash advance. This helped the store to attract new customers and increase its sales.

- A service business was able to hire new employees with its Blursoft merchant cash advance. This helped the business to grow and expand its operations.

Overall, Blursoft is a great option for businesses that need quick and easy access to working capital. The company's flexible repayment terms, transparent pricing, and dedicated customer service make it a great choice for businesses of all sizes.

Here are some additional benefits of using Blursoft for your merchant cash advance:

- Blursoft is a reputable company with a long history of providing merchant cash advances to businesses.

- Blursoft has a strong network of partners, including credit card processors and banks, which gives it access to a wide range of funding options.

- Blursoft is committed to providing its clients with the best possible service and support.

If you are considering a merchant cash advance, I encourage you to contact Blursoft today. The company's friendly and knowledgeable staff will be happy to answer your questions and help you get the financing you need.

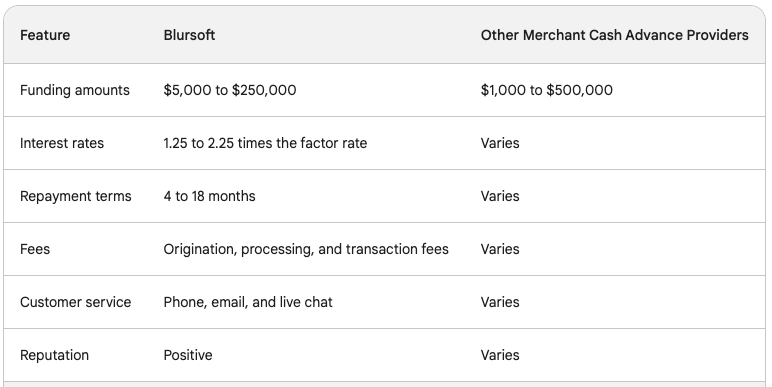

Blursoft vs. Other Merchant Cash Advance Providers

When comparing merchant cash advance providers, it's crucial to consider various factors, including funding amounts, interest rates, repayment terms, fees, customer service, and overall reputation. Here's a comparison between Blursoft and other merchant cash advance providers:

Funding Amounts:

Blursoft offers merchant cash advances ranging from $5,000 to $250,000, while other providers may offer amounts as low as $1,000 or as high as $500,000.

Interest Rates:

Blursoft's interest rates are typically between 1.25 and 2.25 times the factor rate, meaning the interest rate can be as high as 125% to 225% of the original advance amount. Other providers may have higher or lower interest rates depending on their risk assessment of your business.

Repayment Terms:

Blursoft's repayment terms typically range from 4 to 18 months, with daily or weekly deductions from your credit card sales. Other providers may offer shorter or longer repayment terms, with different deduction frequencies.

Fees:

Blursoft may charge origination fees, processing fees, and transaction fees, which can add to the overall cost of the advance. Other providers may have different fee structures.

Customer Service:

Blursoft offers dedicated customer support through phone, email, and live chat. Other providers may have similar or different customer support options.

Reputation:

Blursoft is a reputable merchant cash advance provider with a positive online presence and customer reviews. Other providers may have similar or different reputations.

Overall Comparison:

Blursoft stands out for its fast and easy application process, no collateral requirements, and flexible repayment terms. However, its interest rates can be higher than some other providers. It's essential to compare rates, terms, and fees across multiple providers to find the best fit for your business.

Here's a table summarizing the key points:

Ultimately, the best merchant cash advance provider for your business will depend on your specific needs and circumstances. Carefully evaluate your options and compare rates, terms, and fees before making a decision.

How to Get the Most Out of Your Merchant Cash Advance

Making the most of your merchant cash advance involves using the funds strategically and managing the repayment process effectively. Here are some key strategies to consider:

- Prioritize Growth-Enhancing Investments: Utilize the advance to invest in areas that will directly contribute to your business's growth. This could include purchasing new inventory, expanding your marketing efforts, or hiring additional staff. Allocating funds towards growth initiatives can help you generate more revenue, which will make it easier to repay the advance.

- Improve Cash Flow Management: Implement strategies to optimize your cash flow and ensure you can meet your repayment obligations. This may involve streamlining your invoicing process, negotiating better payment terms with suppliers, and closely monitoring your expenses.

- Communicate Effectively with Your Lender: Maintain open communication with your merchant cash advance provider. Keep them informed about your business's performance and any challenges you may encounter. Transparency can foster a positive relationship and potentially lead to more favorable terms.

- Explore Refinancing Options: If interest rates decline or your business's financial situation improves, consider refinancing your merchant cash advance with a lower-interest loan. This could reduce your overall repayment costs and improve your cash flow.

- Maintain Financial Discipline: Exercise financial discipline to ensure your business can sustain the advance payments. This includes creating a detailed budget, tracking expenses closely, and avoiding unnecessary expenditures.

- Seek Professional Advice: Consult with a financial advisor or business consultant to develop a comprehensive plan for utilizing your merchant cash advance effectively. Their expertise can help you make informed decisions and maximize the benefits of the funding.

- Utilize Technology: Leverage technology to streamline financial management and gain insights into your business's performance. Accounting software, inventory management tools, and point-of-sale systems can provide valuable data and help you make better financial decisions.

- Track Your Progress: Regularly monitor your progress in repaying the advance and achieving your business goals. This will allow you to identify areas for improvement and make adjustments as needed.

- Be Prepared for Unexpected Expenses: Set aside a contingency fund to cover unexpected expenses that may arise. This could help prevent you from relying on further debt or disrupting your repayment plan.

- Stay Informed about Industry Trends: Keep abreast of industry trends and developments that could impact your business. This will allow you to adapt your strategies and ensure your merchant cash advance is being used effectively in a changing landscape.

Conclusion

For businesses seeking a quick, flexible, and accessible source of working capital, Blursoft's merchant cash advances offer a viable solution. With a streamlined application process, rapid funding, and tailored repayment terms, Blursoft empowers businesses to overcome financial hurdles and achieve their goals.

Frequently Asked Questions

What is a merchant cash advance, and how does it differ from traditional loans?A merchant cash advance is not a traditional loan but a cash advance provided to a business in exchange for a percentage of its daily credit card sales. Unlike loans, MCAs have no fixed repayment terms.

How does Blursoft's merchant cash advance work?Blursoft's MCA provides businesses with an upfront cash sum, which is repaid through a daily percentage of their credit card and debit card sales.

What are the key advantages of choosing Blursoft for a merchant cash advance?Blursoft offers quick access to funds, requires no collateral, provides flexible repayment terms, and is accessible to businesses with varying credit scores.

Is a good credit score necessary to qualify for a Blursoft merchant cash advance?No, Blursoft places less emphasis on credit scores and more on daily card sales, making MCAs accessible to businesses with less-than-perfect credit.

What are the typical repayment terms for a Blursoft MCA, and how does the daily repayment process work?Repayment terms vary, but typically, a small percentage of daily card sales is collected automatically until the advance is fully repaid.

Can I use the funds from a Blursoft merchant cash advance for any business purpose?Yes, you have the freedom to allocate the funds as you see fit, whether it's for marketing, inventory, equipment, or other business needs.

How long does the application and approval process for a Blursoft MCA usually take?The application process is streamlined, and approval can happen quickly, often within a few days, allowing for timely access to funds.

Are there any upfront fees or hidden costs associated with obtaining a merchant cash advance from Blursoft?Transparency is a priority at Blursoft, and there are typically no hidden fees or upfront costs. You'll know the terms upfront.

Is my business eligible for a Blursoft merchant cash advance, and what are the qualification criteria?Eligibility criteria may vary, but typically, businesses with a consistent flow of credit card sales and a track record can qualify.