Personal loans for bad credit can be a lifeline for borrowers who need to access cash quickly but have low credit scores. These loans typically have higher interest rates and shorter repayment terms than traditional personal loans, but they can be a good option for borrowers who have few other options.

How do personal loans for bad credit work?

Personal loans for bad credit are unsecured loans, meaning that they are not backed by collateral. This makes them riskier for lenders, which is why they typically have higher interest rates. However, unsecured loans also offer borrowers more flexibility, as they can use the money for any purpose.

Who is eligible?

To be eligible for a personal loan for bad credit, you will typically need to meet the following criteria:

- Be at least 18 years old

- Have a valid Social Security number

- Have a bank account

- Have a steady income

Some lenders may also have a minimum credit score requirement, but this varies from lender to lender.

How to apply for a personal loan for bad credit

To apply for a personal loan for bad credit, you will typically need to follow these steps:

- Choose a lender. There are a number of lenders who offer personal loans to borrowers with bad credit. You can compare offers from multiple lenders online or through a loan broker.

- Gather your documentation. Most lenders will require you to provide documentation of your income, employment, and debt. This may include pay stubs, bank statements, and tax returns.

- Fill out the loan application. The loan application will typically ask for your personal information, financial information, and loan details. Be sure to fill out the application accurately and completely.

- Submit your application. Once you have submitted your application, the lender will review it and make a decision. If you are approved for the loan, you will receive a loan agreement.

- Review and sign the loan agreement. Be sure to read the loan agreement carefully before you sign it. The loan agreement will outline the terms and conditions of the loan, including the interest rate, repayment term, and any fees that apply.

- Receive your loan funds. Once you have signed the loan agreement, you will receive your loan funds. The lender may deposit the funds directly into your bank account or send you a check.

How to choose the best personal loan for bad credit

When choosing a personal loan for bad credit, it is important to compare offers from multiple lenders. This will help you find the best interest rate and repayment terms for your needs.

Here are a few factors to consider when comparing personal loans for bad credit:

- Interest rate: The interest rate is the amount of interest you will pay on the loan. Higher interest rates will result in higher monthly payments.

- Repayment term: The repayment term is the length of time you have to repay the loan. Shorter repayment terms will result in higher monthly payments.

- Fees: Some lenders charge origination fees, prepayment penalties, and other fees. Be sure to factor these fees into your decision-making process.

- Lender reputation: It is important to choose a lender with a good reputation. You can read online reviews and check with the Better Business Bureau to learn more about a lender's reputation.

Types of Personal Loans for Bad Credit

There are a few different types of personal loans for bad credit, each with its own advantages and disadvantages. Here is a brief overview of the most common types:

Secured personal loans

Secured personal loans are backed by collateral, such as a car or home. This makes them less risky for lenders, which means they typically have lower interest rates and longer repayment terms than unsecured loans. However, if you default on the loan, the lender can seize your collateral.

Unsecured personal loans

Unsecured personal loans are not backed by collateral. This makes them riskier for lenders, which is why they typically have higher interest rates and shorter repayment terms than secured loans. However, if you default on the loan, the lender cannot seize your collateral.

Payday loans

Payday loans are a type of short-term loan that is typically repaid on the next payday. Payday loans have very high interest rates and fees, so they should only be used in an emergency.

Bad credit installment loans

Bad credit installment loans are similar to unsecured personal loans, but they have shorter repayment terms and higher interest rates. This makes them a good option for borrowers who need to access cash quickly but have bad credit.

Peer-to-peer loans

Peer-to-peer loans are loans that are funded by individual investors rather than traditional banks. Peer-to-peer loans can be a good option for borrowers with bad credit, but they can also have higher interest rates than traditional loans.

Credit union loans

Credit unions are non-profit financial institutions that offer a variety of banking products, including personal loans. Credit unions often have more flexible lending criteria than traditional banks, which can make them a good option for borrowers with bad credit.

When choosing a personal loan for bad credit, it is important to compare offers from multiple lenders and choose a loan that you can afford to repay. It is also important to read the loan agreement carefully before you sign it.

How to Compare Personal Loans for Bad Credit

When comparing personal loans for bad credit, it is important to consider the following factors:

- Interest rate: The interest rate is the amount of interest you will pay on the loan. A higher interest rate will result in higher monthly payments.

- Repayment term: The repayment term is the length of time you have to repay the loan. A shorter repayment term will result in higher monthly payments.

- Fees: Some lenders charge origination fees, prepayment penalties, and other fees. Be sure to factor these fees into your decision-making process.

- Lender reputation: It is important to choose a lender with a good reputation. You can read online reviews and check with the Better Business Bureau to learn more about a lender's reputation.

Here are some tips for comparing personal loans for bad credit:

- Use a loan comparison website. There are a number of websites that allow you to compare personal loan offers from multiple lenders. This is a convenient way to see all of your options at once.

- Get pre-approved. Getting pre-approved for a loan can help you get an idea of what interest rate and repayment terms you qualify for. It can also help you narrow down your choices of lenders.

- Ask questions. Don't be afraid to ask lenders questions about their loan products. This will help you understand the terms and conditions of the loan and make sure it is a good fit for your needs.

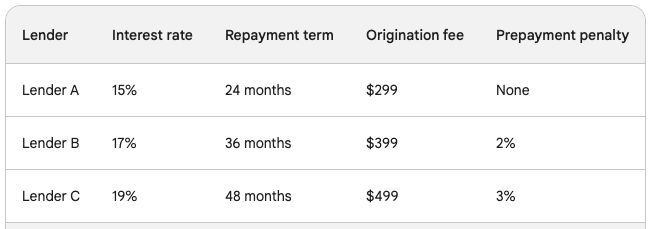

Here is an example of how you could compare personal loans for bad credit:

In this example, Lender A has the lowest interest rate, but it also has the shortest repayment term and the highest origination fee. Lender B has a higher interest rate, but it has a longer repayment term and a lower origination fee. Lender C has the highest interest rate, but it also has the longest repayment term and the lowest origination fee.

The best personal loan for you will depend on your individual needs and circumstances. Be sure to compare offers from multiple lenders and choose a loan that you can afford to repay.

Tips for Repaying a Personal Loan for Bad Credit

Here are some tips for repaying a personal loan for bad credit:

- Create a budget and stick to it. This will help you track your income and expenses and make sure you have enough money to make your loan payments on time and in full.

- Set up automatic payments. This way, you won't have to worry about forgetting to make a payment.

- Make more than the minimum payment. This will help you pay off your loan faster and save money on interest.

- Consider getting a part-time job or side hustle. This can give you extra money to put towards your loan payments.

- Avoid taking on new debt. The more debt you have, the more difficult it will be to repay your loan.

If you're struggling to make your loan payments, be sure to contact your lender. They may be able to work with you to modify your loan terms or create a payment plan that you can afford.

Here are some additional tips that may help you repay your personal loan for bad credit:

- Pay off high-interest debt first. If you have other debt with higher interest rates, such as credit card debt, focus on paying that off first. This will free up more of your income to put towards your personal loan payments.

- Negotiate with your creditors. If you're having trouble making your payments, contact your creditors and see if they're willing to negotiate. They may be willing to lower your interest rates or monthly payments.

- Get help from a financial advisor. If you're struggling to manage your debt, consider getting help from a financial advisor. They can help you create a budget, develop a debt repayment plan, and negotiate with your creditors.

Repaying a personal loan for bad credit can be challenging, but it is possible. By following these tips, you can get yourself on the road to financial freedom.

Conclusion

If you have bad credit, you may still be able to qualify for a personal loan. However, it's important to understand the terms and conditions of these loans before you apply. Be sure to shop around and compare offers from multiple lenders, and make sure you can afford the monthly payments.

Frequently Asked Questions

What are personal loans for bad credit?Personal loans for bad credit are financial products tailored for individuals with subpar credit scores, enabling them to access funds even when traditional lenders might decline them.

How does a bad credit score impact my loan application?A low credit score typically signals to lenders a higher risk of default. Consequently, you might face higher interest rates, stricter terms, or even loan denials.

Can I still get a personal loan with a credit score below 580?Yes, many lenders specialize in offering personal loans to those with credit scores below 580, though the terms might be less favorable than standard personal loans.

What's the difference between secured and unsecured bad credit loans?Secured loans require collateral (like property or a car) which the lender can claim if you default. Unsecured loans don't require collateral but often come with higher interest rates, especially for those with bad credit.

How can personal loans for bad credit help improve my credit score?By consistently making timely repayments on a personal loan, you demonstrate financial responsibility, which can gradually boost your credit score over time.

Are there any trustworthy online lenders for bad credit personal loans?Yes, numerous online lenders cater to individuals with bad credit. However, it's crucial to conduct thorough research, read reviews, and understand the terms before finalizing a lender.

How quickly can I access funds after getting approved for a bad credit personal loan?Depending on the lender, you could receive funds as soon as the same day or within a few business days after approval.

Are there any hidden fees associated with personal loans for bad credit?It varies by lender. Always scrutinize the loan agreement for potential fees, such as origination fees, late fees, and prepayment penalties. Transparent lenders will disclose all fees upfront.

Can I use a personal loan for bad credit to consolidate debt?Absolutely! Many borrowers use bad credit personal loans to consolidate high-interest debts, potentially simplifying their financial situation and saving on interest over time.

What happens if I default on a bad credit personal loan?Defaulting can lead to severe consequences, including increased fees, damage to your credit score, and potential legal action. If secured, the lender might also claim the collateral. It's crucial to communicate with your lender if you foresee repayment difficulties.