Secured loans are a type of loan that requires the borrower to pledge collateral as security. This collateral can be anything of value, such as a house, car, or investment account. If the borrower defaults on the loan, the lender can seize the collateral to recoup their losses. Secured loans are typically considered to be less risky than unsecured loans, which do not require collateral.

Types of Secured Loans

There are many different types of secured loans available, each with its own unique benefits and drawbacks. Here is a list of some of the most common types of secured loans:

- Mortgage loans: Mortgage loans are used to purchase or refinance a home. The home is used as collateral for the loan. Mortgage loans typically have the lowest interest rates of all types of secured loans, but they can also be the most difficult to qualify for.

- Auto loans: Auto loans are used to purchase a car, truck, or other vehicle. The vehicle is used as collateral for the loan. Auto loans typically have higher interest rates than mortgage loans, but they are easier to qualify for.

- Personal secured loans: Personal secured loans can be used for a variety of purposes, such as consolidating debt, paying for medical expenses, or making home improvements. The collateral for personal secured loans can vary depending on the lender, but it may include a car, boat, investment account, or other valuable asset.

- Business secured loans: Business secured loans are used to finance business operations or expansion. The collateral for business secured loans can vary depending on the lender, but it may include business equipment, inventory, or real estate.

- Home equity loans and lines of credit (HELOCs): Home equity loans and HELOCs allow you to borrow against the equity in your home. Home equity loans are typically lump-sum loans, while HELOCs are revolving lines of credit. Home equity loans and HELOCs can be used for a variety of purposes, such as consolidating debt, paying for home improvements, or financing education expenses.

- Secured credit cards: Secured credit cards are a type of credit card that requires a deposit as collateral. The deposit serves as the credit limit for the card. Secured credit cards can be a good way to build credit or improve your credit score.

Which type of secured loan is right for you will depend on your individual needs and circumstances. It is important to compare offers from multiple lenders and choose the loan that has the best terms and interest rate for you.

Here are some additional types of secured loans that may be less common:

- Student loans secured by a cosigner: Some student loans may be secured by a cosigner, who is someone who agrees to repay the loan if you default.

- Pawn shop loans: Pawn shop loans are short-term loans that are secured by a valuable item, such as jewelry or electronics.

- Life insurance loans: You may be able to borrow money against the cash value of your life insurance policy.

- Retirement account loans: You may be able to borrow money against the balance of your retirement account, such as a 401(k) or IRA.

It is important to note that secured loans can be risky. If you default on the loan, the lender can seize the collateral to recoup their losses. Therefore, it is important to only borrow what you can afford to repay and to make sure you understand the terms and conditions of the loan before you sign anything.

Secured Loan vs. Unsecured Loan

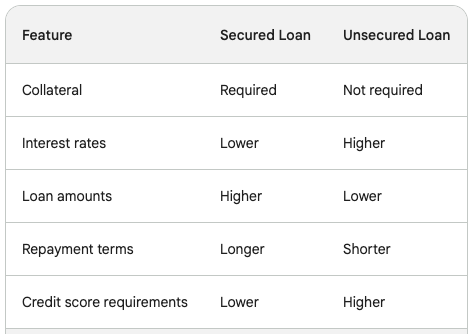

Secured loans and unsecured loans are two different types of loans with different benefits and drawbacks.

- Secured loans require collateral, which is something of value that can be seized by the lender if you default on the loan. The collateral must be worth at least the amount of the loan. Some examples of collateral for secured loans include homes, cars, and investment accounts.

- Unsecured loans do not require collateral. Instead, lenders base their decision on your creditworthiness, which is a measure of your ability to repay the loan. Some examples of unsecured loans include credit cards, personal loans, and student loans.

Here is a table comparing secured and unsecured loans:

Benefits of Secured Loans

Secured loans offer a number of benefits over unsecured loans, including:

- Lower interest rates: Secured loans typically have lower interest rates than unsecured loans because the lender has the security of the collateral in case of default. This can save you a significant amount of money over the life of the loan.

- Higher loan amounts: Secured loans typically have higher loan amounts than unsecured loans. This is because the lender is less risky for the lender due to the collateral. This can be helpful if you need to borrow a large sum of money, such as for a down payment on a house or to start a business.

- Longer repayment terms: Secured loans typically have longer repayment terms than unsecured loans. This can make monthly payments more affordable.

- Easier to qualify for: Secured loans can be easier to qualify for than unsecured loans, especially if you have bad credit or no credit history. This is because the lender has the security of the collateral.

- Can build your credit score: Making regular on-time payments on a secured loan can help you build your credit score. This can make it easier to qualify for other types of loans and credit in the future.

Here are some additional benefits of secured loans:

- Tax deductions: You may be able to deduct the interest paid on a secured loan from your taxes. This can save you money on your taxes.

- More flexibility: Secured loans can be used for a variety of purposes, such as consolidating debt, paying for home improvements, or financing education expenses.

- More peace of mind: Knowing that your collateral can be seized by the lender if you default on the loan can provide some peace of mind. This is because it means that you will not be personally liable for the debt.

Overall, secured loans can be a good option for borrowers who need a lower interest rate, a higher loan amount, or a longer repayment term. However, it is important to compare offers from multiple lenders and make sure you understand the loan agreement before you sign it.

How to Qualify for a Secured Loan

To qualify for a secured loan, you will typically need to:

- Have a good credit score: Lenders will look at your credit score to assess your risk of defaulting on the loan. A good credit score will make it more likely that you will be approved for a loan and get a better interest rate.

- Have a steady income: Lenders will also look at your income to make sure that you can afford to make the monthly payments on the loan. You will typically need to have a debt-to-income ratio (DTI) below 36%.

- Have collateral: Secured loans require collateral, which is something of value that can be seized by the lender if you default on the loan. The collateral must be worth at least the amount of the loan.

Here are some additional tips for qualifying for a secured loan:

- Get pre-approved: Getting pre-approved for a loan before you start shopping will give you an idea of how much you can borrow and what your interest rate will be.

- Shop around: Compare offers from multiple lenders to get the best deal.

- Be honest: Be honest with lenders about your financial situation. This will help them make an informed decision about whether or not to approve you for a loan.

If you have bad credit or no credit history, it may be more difficult to qualify for a secured loan. However, there are some lenders that specialize in loans for borrowers with bad credit. You may also be able to qualify for a secured loan if you have a cosigner, who is someone who agrees to repay the loan if you default.

Here are some additional tips for qualifying for a secured loan if you have bad credit:

- Consider a cosigner: A cosigner can help you qualify for a loan and get a better interest rate.

- Make a larger down payment: Making a larger down payment can reduce the amount of money you need to borrow and make it easier to qualify for a loan.

- Get a secured credit card: A secured credit card can help you build your credit score and make it easier to qualify for a loan in the future.

It is important to note that all lenders have different requirements, so it is important to contact the lender you are interested in to find out their specific requirements for qualifying for a secured loan.

Tips for Getting the Best Deal on a Secured Loan

Here are some tips for getting the best deal on a secured loan:

- Compare offers from multiple lenders. Don't just go with the first lender that offers you a loan. Get quotes from at least three different lenders before you decide.

- Shop around for the best interest rate. Interest rates can vary significantly from one lender to another. Even a small difference in the interest rate can save you a lot of money over the life of the loan.

- Consider the fees. Lenders may charge a variety of fees, such as origination fees, late fees, and prepayment penalties. Make sure you understand all of the fees associated with the loan before you sign anything.

- Negotiate the terms of the loan. Don't be afraid to negotiate the terms of the loan with the lender. You may be able to get a lower interest rate, longer repayment term, or lower fees.

- Read the fine print. Before you sign the loan agreement, make sure you read and understand all of the terms and conditions. This includes the interest rate, repayment terms, fees, and default terms.

Here are some additional tips for getting the best deal on a secured loan:

- Get pre-approved for a loan before you start shopping. This will give you an idea of how much you can borrow and what your interest rate will be.

- Consider a shorter repayment term. A shorter repayment term will mean higher monthly payments, but you will pay less interest overall.

- Make a larger down payment. A larger down payment will reduce the amount of money you need to borrow and make it easier to qualify for a loan.

- Use a collateral value calculator. This will help you determine the value of your collateral and how much you can borrow against it.

- Consider working with a mortgage broker. A mortgage broker can help you compare offers from multiple lenders and find the best deal on a loan.

By following these tips, you can increase your chances of getting the best deal on a secured loan.

Conclusion

Secured loans can be a good option for borrowers who need a lower interest rate, a higher loan amount, or a longer repayment term. However, it is important to compare offers from multiple lenders and make sure you understand the loan agreement before you sign it.

Frequently Asked Questions

What is a secured loan?A secured loan is a type of loan that is backed by collateral, which is an asset that the borrower offers to the lender as security for the loan. If the borrower fails to repay the loan, the lender can seize the collateral to recover their funds.

What can be used as collateral for a secured loan?Collateral can be any asset of value such as a house, car, savings accounts, or investment securities. The type of collateral accepted may vary depending on the lender and the amount of the loan.

How does a secured loan differ from an unsecured loan?The main difference is that a secured loan requires collateral, while an unsecured loan does not. Consequently, secured loans typically have lower interest rates due to the lower risk involved for the lender.

What are the benefits of a secured loan?Benefits include potentially lower interest rates, higher borrowing limits, and longer repayment terms compared to unsecured loans. They may also be easier to obtain if you have less-than-perfect credit because the loan is backed by an asset.

Are secured loans easier to get than unsecured loans?Generally, yes, because the lender has the collateral to fall back on, which reduces their risk. This can make lenders more willing to offer loans to individuals with lower credit scores or less credit history.

What are the risks of a secured loan?The primary risk is losing the asset you put up as collateral if you are unable to repay the loan. It's important to borrow responsibly and ensure that the loan payments are within your budget.

Can I use my home as collateral for a secured loan?Yes, a common type of secured loan that uses your home as collateral is known as a home equity loan or a second mortgage.

What happens if I default on a secured loan?If you default on a secured loan, the lender has the legal right to take possession of the collateral, sell it, and use the proceeds to pay off the loan balance and any related fees.

How much can I borrow with a secured loan?The loan amount can vary widely depending on the value of the collateral, your creditworthiness, income, and the lender's policies. Typically, lenders allow you to borrow up to a certain percentage of the collateral's value.

Can I pay off a secured loan early?Yes, you can usually pay off a secured loan early, but some lenders may charge an early repayment fee. It's important to review the terms of your loan agreement to understand any potential penalties or fees associated with early repayment.