TJ Maxx credit card is designed to reward loyal shoppers. There are two types of cards available: the TJX Rewards® Platinum Mastercard and the TJX Rewards® Credit Card. The primary difference between the two is that the Platinum Mastercard can be used anywhere Mastercard is accepted, while the TJX Rewards Credit Card can only be used at TJ Maxx and its affiliated stores, including Marshalls, HomeGoods, Sierra, and Homesense.

Exclusive Savings and Discounts

One of the most enticing aspects of the TJ Maxx credit card is the exclusive savings and discounts it offers. Cardholders can enjoy benefits such as 10% off their first in-store purchase when they open an account, and this can be combined with ongoing discounts and promotions available at TJ Maxx. Additionally, cardholders receive points for every dollar spent at TJ Maxx stores and their affiliates. Once you accumulate 1,000 points, you'll receive a $10 rewards certificate that can be used for future purchases.

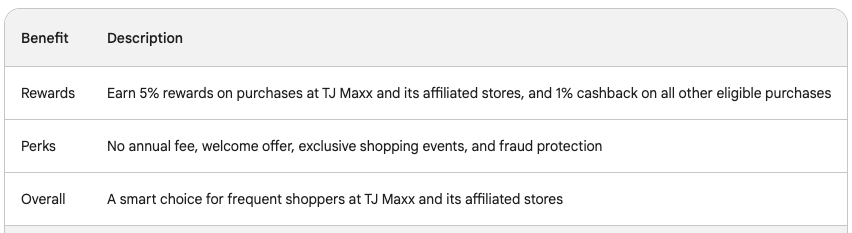

TJ Maxx Credit Card Benefits

The TJ Maxx credit card offers a variety of benefits to cardholders, including:

Rewards

- Earn 5% rewards on purchases at TJ Maxx, Marshalls, HomeGoods, Sierra Trading Post, and Homesense

- Earn 1% cashback on all other eligible purchases

- Redeem rewards for statement credits or merchandise certificates

Perks

- No annual fee

- Welcome offer, often in the form of a discount or cashback bonus

- Exclusive shopping events with early access to new merchandise and additional discounts

- Fraud protection to safeguard your financial information

Overall

The TJX Rewards® Credit Card is a no-annual-fee Mastercard® that offers generous rewards and exclusive perks to frequent shoppers at TJ Maxx and its affiliated stores. It's a smart choice for those who want to maximize their savings while enjoying their shopping experiences.

Here is a summary of the key benefits:

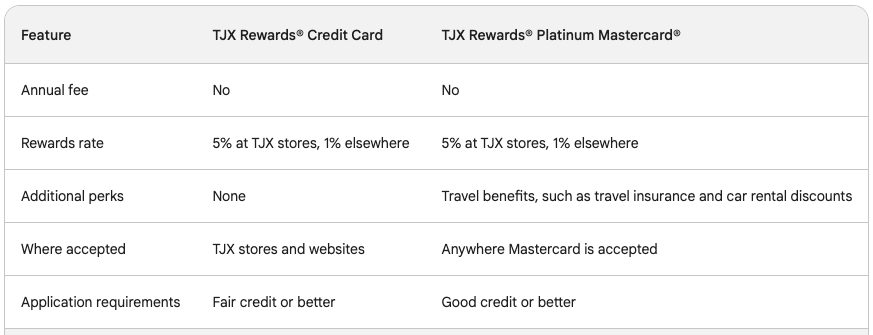

TJ Maxx Credit Card Types

TJX Rewards® Credit Card is the only credit card offered by TJ Maxx and its affiliated stores. It is a no-annual-fee Mastercard® that offers generous rewards and exclusive perks to frequent shoppers at TJ Maxx and its affiliated stores.

There are two versions of the TJX Rewards® Credit Card:

- TJX Rewards® Credit Card: This is a store card that can only be used at T.J. Maxx and its partner brands in the U.S. and Puerto Rico or through any of the brands' websites.

- TJX Rewards® Platinum Mastercard®: This is a credit card that can be used anywhere Mastercard is accepted. It offers the same rewards as the store card, plus additional travel benefits.

Here is a table summarizing the key differences between the two cards:

Choosing the Right Card for You

The best TJX Rewards® Credit Card for you will depend on your individual needs and spending habits. If you shop at TJX stores frequently, the store card is a good option because it offers a slightly higher rewards rate on purchases at these stores. However, if you travel often, the Platinum Mastercard® is a better choice because it offers travel benefits that can save you money.

Here are some additional factors to consider when choosing a TJX Rewards® Credit Card:

- Your credit score: If you have fair credit, you may be approved for the store card. However, if you have good credit, you are more likely to be approved for the Platinum Mastercard®.

- Your spending habits: If you shop at TJX stores frequently, the store card is a good option. However, if you shop at a variety of stores, the Platinum Mastercard® is a better choice because it can be used anywhere Mastercard is accepted.

Maximizing Savings with TJ Maxx Credit Card

To maximize your savings with the TJX Rewards® Credit Card, follow these strategies:

- Shop at TJX Stores Regularly: The key to maximizing your rewards with this card is to shop at TJX stores frequently. Since you earn 5% cashback on purchases at T.J. Maxx, Marshalls, HomeGoods, Sierra Trading Post, and Homesense, the more you shop, the more rewards you'll accumulate.

- Take Advantage of Special Shopping Events: As a cardholder, you'll receive exclusive invitations to special shopping events, often offering early access to new merchandise and additional discounts. These events can provide significant savings opportunities, allowing you to stretch your shopping budget further.

- Utilize Rewards for Statement Credits: Once you've accumulated enough rewards, redeem them for statement credits. This will directly reduce your monthly bills, effectively saving you money on your purchases.

- Consider the Platinum Mastercard for Travel Benefits: If you travel frequently, consider upgrading to the TJX Rewards® Platinum Mastercard®. This card offers travel benefits, such as travel insurance and car rental discounts, which can further enhance your savings.

- Pay Your Balance in Full Each Month: To avoid paying interest charges, which would diminish your savings, make sure to pay your credit card balance in full each month. This will allow you to fully reap the benefits of the card's rewards and perks without incurring additional costs.

- Monitor Your Rewards Redemptions: Keep track of your rewards balance and ensure you're redeeming them before they expire. Rewards points typically don't expire, but it's always a good practice to stay on top of your redemptions.

- Check for Welcome Offers and Limited-Time Promotions: TJX often offers welcome bonuses and limited-time promotions for new cardholders. Take advantage of these opportunities to boost your savings right away.

- Combine Rewards with Couponing and Sale Shopping: For maximum savings, combine your TJX Rewards® Credit Card with couponing and sale shopping strategies. This can help you maximize your savings on individual purchases and over time.

By following these strategies, you can effectively maximize your savings with the TJX Rewards® Credit Card and enjoy the benefits of being a savvy shopper.

Special Financing Offers

TJX Rewards®, the company that runs TJ Maxx, Marshalls, HomeGoods, Sierra Trading Post, and Homesense, does not currently offer special financing on purchases made with their credit card. However, they do offer a variety of other benefits, such as:

- 0% APR for new cardholders: New cardholders may be eligible for a 0% APR on purchases made within the first 6 months of opening their account.

- 5% rewards: Cardholders earn 5% rewards on purchases made at TJ Maxx and other TJX stores, and 1% rewards on purchases made elsewhere.

- Exclusive shopping events: Cardholders are often invited to exclusive shopping events, offering early access to new merchandise and additional discounts.

- Travel benefits: The TJX Rewards® Platinum Mastercard® offers travel benefits, such as travel insurance and car rental discounts.

- No annual fee: The TJX Rewards® Credit Card has no annual fee.

Exclusive Shopping Events

TJ Maxx credit cardholders are often invited to exclusive shopping events, offering early access to new merchandise and additional discounts. These events can provide significant savings opportunities, allowing you to stretch your shopping budget further.

Here are some of the benefits of attending TJ Maxx exclusive shopping events:

- Early access to new merchandise: You'll be among the first to see and shop for new items, before they're available to the general public. This is a great opportunity to snag the latest trends and styles.

- Additional discounts: In addition to the already low prices at TJ Maxx, you'll often find even deeper discounts at exclusive shopping events. This can save you a significant amount of money on your purchases.

- Refreshments and treats: Many exclusive shopping events offer refreshments and treats for cardholders. This is a nice perk that can make your shopping experience even more enjoyable.

- Special giveaways: Some exclusive shopping events also feature raffles and giveaways, where you can win prizes like gift cards or merchandise. This is a great way to get something extra for your shopping trip.

How to Find Out About Exclusive Shopping Events

If you're a TJ Maxx credit cardholder, there are a few ways to find out about exclusive shopping events:

- Check your email: TJ Maxx often sends emails to cardholders about upcoming events.

- Check the TJ Maxx website: The TJ Maxx website has a page that lists upcoming exclusive shopping events.

- Follow TJ Maxx on social media: TJ Maxx often announces upcoming exclusive shopping events on their social media channels.

When do exclusive shopping events typically happen?

Exclusive shopping events typically happen a few times a year, around major holidays and seasons. For example, there may be an exclusive shopping event before the back-to-school season or the holidays.

Tips for Attending Exclusive Shopping Events

If you're planning to attend an exclusive shopping event, here are a few tips:

- Arrive early: The best merchandise tends to go quickly, so it's a good idea to arrive early to the event.

- Make a list: Before you go, make a list of the items you're looking for. This will help you stay focused and avoid impulse purchases.

- Be prepared to try things on: TJ Maxx doesn't have fitting rooms, so be prepared to try things on in the aisles or in a public area.

- Be patient: Exclusive shopping events can be crowded, so be patient and polite with other shoppers and staff.

Managing Your TJ Maxx Credit Card Account

Managing your TJ Maxx credit card account is a simple process that can be done online, through the Synchrony Bank mobile app, or by phone. Here are some of the things you can do to manage your account:

- Check your balance: You can check your balance online, through the mobile app, or by calling customer service.

- Make a payment: You can make a payment online, through the mobile app, by mail, or by phone. You can also set up automatic payments to be deducted from your checking account each month.

- Sign up for paperless statements: You can sign up for paperless statements to receive your statements electronically instead of in the mail. This is a more environmentally friendly option and it can also help you avoid late fees.

- Update your information: If you change your name, address, or phone number, you can update your information online or by calling customer service.

- Request a credit card increase: If you would like to increase your credit limit, you can request a credit increase online or by calling customer service.

- Report a lost or stolen card: If you lose your card or it is stolen, you should report it immediately to customer service. They will cancel your card and issue you a new one.

- Dispute a charge: If you see a charge on your statement that you do not recognize, you can dispute it online or by calling customer service.

Here are some additional tips for managing your TJ Maxx credit card account:

- Pay your balance in full each month: This will help you avoid paying interest charges and it will also keep your credit score healthy.

- Use your card responsibly: Only use your card for purchases that you can afford to pay off.

- Monitor your credit score: You can check your credit score for free once a year through AnnualCreditReport.com. This will help you track your credit progress and make sure you are staying on track.

By following these tips, you can easily manage your TJ Maxx credit card account and avoid any problems.

Conclusion

The TJX Rewards® Credit Card is a great option for frequent shoppers at TJ Maxx and its affiliated stores. With its generous rewards, exclusive perks, and no annual fee, it's a smart choice for savvy bargain hunters.

Frequently Asked Questions

What is the TJ Maxx Credit Card?The TJ Maxx Credit Card is a store credit card that offers exclusive benefits and rewards for shoppers at TJ Maxx and its affiliated stores.

What are the Different Types of TJ Maxx Credit Cards?There are two types: the TJX Rewards® Platinum Mastercard and the TJX Rewards® Credit Card.

Can I Use the TJ Maxx Credit Card Anywhere?The TJX Rewards® Platinum Mastercard can be used anywhere Mastercard is accepted, while the TJX Rewards® Credit Card is limited to TJ Maxx and affiliated stores.

What Are the Benefits of Having a TJ Maxx Credit Card?Cardholders enjoy benefits such as discounts on their first in-store purchase, points for every dollar spent, special financing offers, and exclusive shopping events.

How Do the Points System and Rewards Work?Cardholders earn points for every dollar spent, and once they accumulate 1,000 points, they receive a $10 rewards certificate.

Are There Any Annual Fees for the TJ Maxx Credit Card?There are no annual fees associated with the TJ Maxx Credit Card.

Can I Apply for a TJ Maxx Credit Card Online?Yes, you can apply for a TJ Maxx Credit Card online through the official website or in-store.

What Are the Special Financing Offers, and How Do They Work?Depending on the amount of your purchase and creditworthiness, you may qualify for six, twelve, or eighteen months of special financing with no interest, provided you make minimum payments on time.

How Do I Manage My TJ Maxx Credit Card Account Online?You can manage your account online by logging in to the official website. This allows you to check your balance, view transaction history, make payments, and update account information.

Are There Any Exclusive Discounts or Promotions for TJ Maxx Credit Cardholders?Yes, TJ Maxx often offers exclusive discounts, promotions, and early access to shopping events for its credit cardholders. Cardholders also receive advance notice of upcoming sales and promotions.