Holiday loans for bad credit can be a lifesaver for people who want to enjoy the holiday season but don't have the cash upfront. While it may be difficult to qualify for a traditional personal loan from a bank with bad credit, there are a number of alternative lenders that offer holiday loans specifically for people with bad credit.

Why Consider a Holiday Loan?

There are a number of reasons why you might consider taking out a holiday loan, including:

- To cover unexpected expenses. If you have a sudden expense, such as a car repair or medical bill, a holiday loan can help you cover the cost without having to dip into your savings.

- To finance a vacation. If you've been dreaming of taking a holiday vacation, a holiday loan can help you make your dream a reality.

- To buy gifts. If you're on a tight budget, a holiday loan can help you afford to buy gifts for your loved ones.

- To host a holiday party. If you're hosting a holiday party, a holiday loan can help you cover the cost of food, drinks, and decorations.

Types of holiday loans for bad credit

Here are some of the types of holiday loans available for people with bad credit:

- Personal loans: Personal loans are the most common type of holiday loan. They can be used for any purpose, including covering holiday expenses. Personal loans are typically unsecured, meaning that you don't need to put up collateral to qualify. However, personal loans for bad credit typically have higher interest rates and shorter repayment terms than personal loans for borrowers with good credit.

- Payday loans: Payday loans are small, short-term loans that are designed to be repaid on your next payday. Payday loans are very easy to qualify for, even for people with bad credit. However, payday loans come with very high interest rates and fees. In fact, payday loans are often considered to be predatory lending.

- Title loans: Title loans are secured loans that use your car title as collateral. Title loans can be used for any purpose, including covering holiday expenses. Title loans typically have lower interest rates than payday loans, but they still come with a high risk of default. If you default on a title loan, the lender can seize your car.

- Credit union loans: Credit unions are financial institutions that are owned and operated by their members. Credit unions often offer holiday loans to members with bad credit. Credit union loans typically have lower interest rates and fees than traditional bank loans.

- Buy now, pay later (BNPL) plans: BNPL plans allow you to purchase goods and services online and pay for them in installments over time. BNPL plans are typically available for purchases made online, but they can also be used for in-store purchases at some retailers. Some BNPL plans offer interest-free payments, but others do charge interest.

When choosing a holiday loan, it's important to compare interest rates, fees, and repayment terms from different lenders. It's also important to make sure that you can afford the monthly payments.

How to choose the right holiday loan for you with bad credit

When choosing a holiday loan with bad credit, it's important to consider the following factors:

- Interest rate: The interest rate is the amount of money you'll pay to borrow the money. Make sure to compare interest rates from different lenders before choosing a loan. Loans for bad credit typically have higher interest rates than loans for borrowers with good credit.

- Fees: Many lenders charge fees for holiday loans, such as origination fees and late payment fees. Be sure to ask about fees before you apply for a loan.

- Repayment terms: The repayment terms will determine how long you have to repay the loan and how much your monthly payments will be. Choose a loan with repayment terms that you can afford.

- Lender reputation: It's important to choose a lender with a good reputation. You can read online reviews to learn what other borrowers have experienced with different lenders.

- Type of loan: There are a few different types of holiday loans available for borrowers with bad credit, such as personal loans, payday loans, title loans, and credit union loans. Each type of loan has its own advantages and disadvantages. Be sure to compare the different types of loans before choosing one.

Tips for getting approved for a holiday loan with bad credit

Here are some tips for getting approved for a holiday loan with bad credit:

- Apply with multiple lenders. Don't just apply for a loan with the first lender you find. Apply with multiple lenders to increase your chances of approval. Some lenders may be more willing to work with borrowers with bad credit than others.

- Get a cosigner. A cosigner is someone with good credit who agrees to repay the loan if you default. Having a cosigner can make you more attractive to lenders and help you qualify for a better interest rate.

- Offer collateral. If you can't get approved for an unsecured loan, you may be able to get approved for a secured loan by offering collateral. Collateral is an asset that the lender can seize if you default on the loan. Some common types of collateral for holiday loans include cars, jewelry, and savings accounts.

- Be honest about your financial situation. When you apply for a loan, be honest about your income, expenses, and debts. This will help the lender make an informed decision about whether to approve your loan and what interest rate to offer you.

- Improve your credit score. Even if you have bad credit, there are things you can do to improve your credit score before applying for a loan. These include paying your bills on time, keeping your credit utilization low, and disputing any errors on your credit report.

How to compare interest rates, fees, and repayment terms for holiday loans

To compare interest rates, fees, and repayment terms for holiday loans, you can use the following steps:

- Shop around and get quotes from multiple lenders. You can use a loan comparison website or contact lenders directly to get quotes.

- Compare the following:

- Interest rate: The interest rate is the percentage of the loan amount that you will pay in interest. The lower the interest rate, the less you will pay in interest over the life of the loan.

- Fees: Many lenders charge fees for holiday loans, such as origination fees, late payment fees, and prepayment penalties. Be sure to compare the fees charged by different lenders.

- Repayment terms: The repayment terms will determine how long you have to repay the loan and how much your monthly payments will be. Choose a loan with repayment terms that you can afford.

- Consider the following factors:

- Your credit score: Your credit score will affect the interest rate and fees that you are offered. Borrowers with good credit scores typically qualify for lower interest rates and fees.

- The loan amount: The loan amount will also affect the interest rate and fees that you are offered. Larger loans typically have lower interest rates and fees than smaller loans.

- The loan type: There are a variety of different types of holiday loans available, such as personal loans, payday loans, title loans, and credit union loans. Each type of loan has its own advantages and disadvantages. Be sure to compare the different types of loans before choosing one.

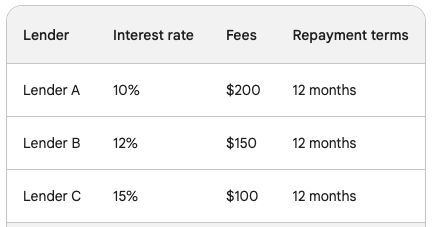

Here is an example of how to compare holiday loans:

Assume that you are looking for a $2,000 holiday loan and you have a credit score of 650. You get quotes from three different lenders:

Based on this information, Lender C is the best option because it has the lowest interest rate and fees. However, it is important to consider all of the factors involved before making a decision. For example, if you need the loan immediately, you may want to choose Lender A even though it has the highest interest rate and fees. This is because Lender A offers the fastest funding time.

What to do if you're denied for a holiday loan

If you're denied for a holiday loan, there are a few things you can do:

- Review the denial letter. The lender should provide you with a letter explaining why you were denied. This letter will give you specific information about your credit score, debt-to-income ratio, and other factors that contributed to the denial.

- Check your credit report. Once you know why you were denied, you can start to take steps to improve your credit score. You can get a free copy of your credit report from each of the three major credit bureaus once a year at annualcreditreport.com. Review your credit report carefully for any errors or inaccurate information. If you find any errors, dispute them with the credit bureaus.

- Reduce your debt. The lower your debt-to-income ratio, the more attractive you will be to lenders. Make a plan to pay down your debt as quickly as possible. You may want to consider making a budget and/or getting a part-time job to help you pay down your debt faster.

- Shop around for a different lender. Not all lenders have the same requirements. Some lenders may be more willing to work with borrowers with bad credit than others. Get quotes from multiple lenders before choosing a loan.

- Consider a cosigner. If you have a cosigner with good credit, they may be able to help you qualify for a loan. A cosigner is someone who agrees to repay the loan if you default.

- Look for alternative ways to get the money you need. If you're unable to qualify for a loan, there are other ways to get the money you need for the holidays. You may want to consider asking friends or family for help, or getting a part-time job. You may also want to consider selling unwanted items or using a credit card to make purchases, but be sure to pay off the balance in full by the end of the month to avoid interest charges.

It's important to remember that you're not alone if you've been denied for a holiday loan. Many people struggle with bad credit and are unable to qualify for loans. However, there are steps you can take to improve your credit score and make yourself more attractive to lenders in the future.

Alternatives to holiday loans for bad credit

If you have bad credit and are unable to qualify for a holiday loan, there are a number of alternatives available to you. Here are a few options to consider:

- Savings Plan: If the holiday is some time away, consider starting a savings plan now. Setting aside a little money each week can add up over time.

- Budget Adjustments: Review your current spending and see where you can cut back to save for the holidays. Sometimes, small sacrifices can free up enough for gifts and festivities.

- Layaway Programs: Many retailers offer layaway programs where you can pay for items over time without accruing interest. This can be a good way to manage holiday spending.

- Handmade Gifts: Consider making gifts rather than purchasing them. Handmade items can be more personal and less costly.

- Community Assistance Programs: Look for local community programs that assist those in need during the holidays. Some organizations provide free toys for children, food, and other assistance.

- Holiday Work: Taking on a temporary job during the holiday season can provide extra income for holiday expenses.

- Short-Term Work or Gigs: Engage in gig economy jobs like ride-sharing, food delivery, or freelancing, depending on your skills and availability.

It's important to note that some of these alternatives can be costly or risky.

Frequently Asked Questions

What exactly is a holiday loan for bad credit?A holiday loan for bad credit is a personal loan specifically offered to individuals with a poor credit history to help finance holiday-related expenses.

Can I qualify for a holiday loan with a bad credit score?Yes, there are lenders who specialize in loans for individuals with bad credit, though terms and interest rates may vary.

What kind of interest rates should I expect with a bad credit holiday loan?Interest rates on bad credit holiday loans are typically higher than those for individuals with good credit, reflecting the increased risk to the lender.

Are no-credit-check holiday loans available?Some lenders may offer holiday loans without a credit check, but these can come with higher interest rates and fees.

What is the maximum amount I can borrow with a bad credit holiday loan?The amount you can borrow may be limited compared to standard personal loans, and will depend on the lender's policies and your ability to repay.

How do I apply for a holiday loan if my credit is poor?You can apply through lenders who offer bad credit loans, either online or in person, providing necessary documentation like proof of income and identification.

What are the dangers of taking out a holiday loan with bad credit?High-interest rates and fees can lead to a debt spiral if not managed properly, and failing to repay the loan can further damage your credit score.

How long does it take to receive funds from a bad credit holiday loan?Depending on the lender, funds can be disbursed as quickly as the same day or within a few business days after approval.

What are some alternatives to taking out a holiday loan if I have bad credit?Alternatives include saving in advance, budgeting holiday spending, getting a seasonal job, or seeking assistance from community organizations.

Will a holiday loan with bad credit affect my credit score?Taking out a holiday loan may affect your credit score; if managed well and repaid on time, it could have a positive impact, but if you miss payments, it could cause further damage.