Personal installment loans are a type of loan that allows you to borrow a fixed amount of money and pay it back over a set period of time in fixed monthly installments. These loans can be used for a variety of purposes, such as consolidating debt, making a large purchase, or covering unexpected expenses.

Personal installment loans are typically unsecured, meaning that you do not need to provide collateral to qualify. However, borrowers with good credit scores and low debt-to-income ratios are generally offered lower interest rates and better terms.

How Personal Installment Loans Work

When you apply for a personal installment loan, the lender will review your credit history and financial situation to determine if you are eligible and what interest rate you qualify for. If you are approved, the lender will give you the full amount of the loan upfront. You will then repay the loan in equal monthly installments over the course of the loan term.

The length of the loan term can vary depending on the lender and the amount you borrow. Typical loan terms range from 3 to 5 years, but some lenders may offer longer or shorter terms.

Benefits and drawbacks

- Fixed monthly payments: Personal installment loans have fixed monthly payments, which can make it easier to budget for your loan repayment.

- No collateral required: Personal installment loans are typically unsecured, so you do not need to provide collateral to qualify. This makes them a good option for borrowers with poor credit or limited assets.

- Variety of uses: Personal installment loans can be used for a variety of purposes, such as consolidating debt, making a large purchase, or covering unexpected expenses.

- Fast funding: Personal installment loans can often be funded quickly, sometimes within a few days.

- Potential to improve credit score: Making on-time payments on a personal installment loan can help to improve your credit score.

Drawbacks of personal installment loans:

- Interest rates: Personal installment loans can have high interest rates, especially for borrowers with poor credit.

- Fees: Some lenders may charge additional fees for personal installment loans, such as origination fees, late payment fees, and prepayment penalties.

- Long-term commitment: Personal installment loans can have loan terms of several years, so it is important to make sure you can afford the monthly payments for the entire duration of the loan.

- Risk of default: If you default on a personal installment loan, the lender may take legal action to collect the debt. This could include damaging your credit score and garnishing your wages.

Overall, personal installment loans can be a good option for borrowers who need to borrow money quickly and easily, and who can afford the monthly payments. However, it is important to weigh the benefits and drawbacks carefully before taking out a personal installment loan.

How to compare personal installment loans

When comparing personal installment loans, it is important to consider the following factors:

- Interest rate: The interest rate is the most important factor to consider when comparing personal installment loans. A lower interest rate will save you money over the life of the loan.

- Fees: Be sure to compare the fees charged by different lenders. Some lenders may charge origination fees, late payment fees, and prepayment penalties.

- Loan term: The loan term is the length of time you have to repay the loan. A longer loan term will result in lower monthly payments, but you will pay more interest over the life of the loan.

- Lender reputation: It is important to borrow from a reputable lender. Read online reviews and compare the ratings of different lenders before choosing one.

Here are some tips for comparing personal installment loans:

- Get pre-approved: Getting pre-approved for a personal installment loan will give you an idea of the interest rate and terms you qualify for. It will also help you to narrow down your choices of lenders.

- Use a loan comparison website: There are a number of websites that allow you to compare personal installment loans from different lenders. This can be a helpful way to find the best deal possible.

- Read the fine print: Before you sign any loan agreement, be sure to read the fine print carefully. This will help you to understand the terms of the loan and any potential fees.

Where to get a personal installment loan

Personal installment loans can be obtained from a variety of lenders, including:

- Banks: Many banks offer personal installment loans to their customers. You may be able to get a lower interest rate and better terms on a personal loan from your bank if you have a good credit history and banking relationship with them.

- Credit unions: Credit unions are non-profit financial institutions that offer personal installment loans to their members. Credit unions often have lower interest rates and fees than banks.

- Online lenders: There are a number of online lenders that offer personal installment loans. Online lenders can be a good option for borrowers with poor credit or limited assets, as they may be more willing to lend to these borrowers.

Here are some tips for choosing a lender for a personal installment loan:

- Compare offers from multiple lenders. This will help you to find the best deal possible on your loan.

- Read online reviews of different lenders. This can help you to learn about the customer service experience and reputation of different lenders.

- Make sure the lender is licensed and insured. This will protect you in case the lender goes out of business or there is a problem with your loan.

How to apply for a personal installment loan

To apply for a personal installment loan, you will typically need to provide the following information:

- Personal information: Your name, address, date of birth, and Social Security number.

- Employment information: Your job title, employer, and annual income.

- Financial information: Your bank account information and monthly expenses.

Once you have gathered this information, you can start the application process. You can apply for a personal installment loan online, in person at a bank or credit union, or over the phone.

Here are the steps involved in applying for a personal installment loan:

- Choose a lender. Compare offers from multiple lenders to find the best deal possible.

- Gather your required documents. This will typically include proof of income, employment, and identity.

- Complete the loan application. The application will ask you for personal, financial, and employment information.

- Submit your application. Once you have submitted your application, the lender will review your credit history and financial situation.

- Get approved. If you are approved, the lender will send you a loan agreement.

- Sign the loan agreement. Once you have signed the loan agreement, the lender will fund your loan.

Here are some tips for applying for a personal installment loan:

- Check your credit score before you apply. This will give you an idea of your chances of getting approved and what interest rate you qualify for.

- Be prepared to provide documentation of your income and employment. This will help the lender to verify your ability to repay the loan.

- Be honest and accurate on your loan application. Providing false information could result in your application being denied or in you being charged higher interest rates and fees.

- Shop around for the best interest rate and terms. Compare offers from multiple lenders to find the best loan for you.

Personal installment loan rates and terms

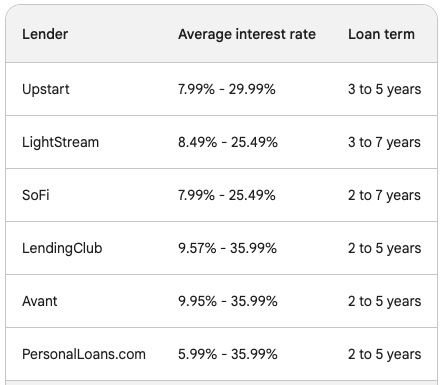

Personal installment loan rates and terms vary depending on the lender, the borrower's credit score, and other factors. However, as of November 2023, the average interest rate on a personal installment loan is between 9.57% and 35.99%. Loan terms typically range from 2 to 5 years, but some lenders may offer longer or shorter terms.

Here is a table of average personal installment loan rates and terms from some popular lenders:

It is important to note that these are just averages. Your actual interest rate and loan term may vary depending on your individual circumstances.

Personal installment loans for bad credit

Personal installment loans for bad credit are available from a variety of lenders, including online lenders and credit unions. These loans are designed for borrowers with credit scores of 600 or below.

When applying for a personal installment loan for bad credit, borrowers should expect to pay higher interest rates and fees than borrowers with good credit. However, these loans can be a good option for borrowers who need to borrow money quickly and easily, and who are willing to pay higher interest rates.

Here are some tips for getting a personal installment loan for bad credit:

- Shop around and compare offers from multiple lenders. There are a number of lenders that offer personal installment loans for bad credit, so it is important to compare offers to find the best deal possible.

- Be prepared to provide documentation of your income and employment. This will help the lender to verify your ability to repay the loan.

- Consider a joint loan. If you have a good credit score and a co-borrower with a good credit score, you may be able to qualify for a lower interest rate on a joint personal loan.

- Make a larger down payment. If you can make a larger down payment on your loan, you will reduce the amount of money you need to borrow and the amount of interest you will pay over the life of the loan.

Personal installment loans for bad credit can be a good option for borrowers who need to borrow money quickly and easily, and who are willing to pay higher interest rates. However, it is important to shop around and compare offers from multiple lenders to find the best deal possible.

Conclusion

Personal installment loans can be a valuable financial tool when used responsibly. They provide a structured and predictable way to address immediate financial needs while allowing borrowers to build their credit history. Before committing to a personal installment loan, it's essential to research and compare options, ensuring that the terms align with your financial goals. With careful consideration and responsible financial management, personal installment loans can be a stepping stone towards achieving greater financial stability.

Frequently Asked Questions

What is a personal installment loan?A personal installment loan is a type of unsecured loan where borrowers receive a lump sum of money upfront and repay it over a fixed period through regular, scheduled payments, usually monthly. These payments cover both the principal amount borrowed and the accrued interest.

How do personal installment loans differ from other types of loans?Unlike revolving credit lines such as credit cards, personal installment loans have a fixed term and fixed monthly payments. This structure provides borrowers with predictability in repayment, making it easier to budget.

What can I use a personal installment loan for?Personal installment loans can be used for a variety of purposes, including consolidating debt, covering medical expenses, home improvements, education costs, or any other significant personal expenses. Lenders typically do not restrict the use of the funds, offering flexibility to borrowers.

How do interest rates work on personal installment loans?Interest rates on personal installment loans can be fixed or variable. A fixed interest rate remains constant throughout the loan term, providing predictability in monthly payments. Variable rates may change over time, impacting the total cost of the loan.

Can I prepay my personal installment loan?Yes, many personal installment loans allow for prepayment without penalties. However, it's essential to check with the lender beforehand, as some loans may have prepayment fees or restrictions.

How is my eligibility for a personal installment loan determined?Lenders consider various factors when determining eligibility, including credit history, income, employment status, and debt-to-income ratio. A good credit score generally improves your chances of approval and may lead to more favorable loan terms.

What is the typical loan term for a personal installment loan?Loan terms for personal installment loans vary but commonly range from one to five years. Shorter terms often have higher monthly payments but lower overall interest costs, while longer terms may have lower monthly payments but higher overall interest expenses.

Can I get a personal installment loan with bad credit?While it may be challenging to secure a personal installment loan with bad credit, some lenders specialize in working with individuals with less-than-perfect credit. Expect higher interest rates and less favorable terms if your credit score is lower.

Are there fees associated with personal installment loans?Yes, there can be fees associated with personal installment loans, such as origination fees, late payment fees, or prepayment penalties. It's crucial to carefully review the terms and conditions to understand all potential fees before accepting the loan.

How does taking out a personal installment loan affect my credit score?Taking out a personal installment loan can impact your credit score in several ways. Initially, a hard inquiry may slightly lower your score. However, making timely payments on the loan can positively affect your credit history, potentially improving your credit score over time. On the flip side, missing payments or defaulting can have adverse effects on your credit.