Installment loans no credit check can be a lifesaver if you need cash quickly and don't have good credit or a credit history at all. These loans allow you to repay the money you borrow in fixed installments over a period of time, typically several months or years.

How Do Installment Loans No Credit Check Work?

To apply for an installment loan no credit check, you'll need to provide the lender with some basic information, such as your name, address, income, and employment status. The lender will review your information and make a decision about whether to approve your loan.

Unlike traditional lenders, installment loan lenders no credit check typically don't pull your credit report or credit score. This means that even if you have bad credit or no credit history, you may still be able to get approved for a loan.

How Much Can You Borrow?

The amount of money you can borrow with an installment loan no credit check will vary depending on the lender. However, most lenders offer loans between $500 and $5,000.

What Are the Interest Rates on Installment Loans No Credit Check?

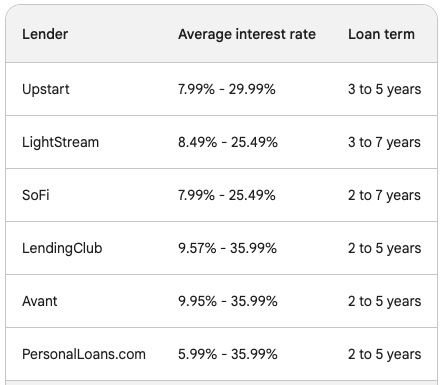

Interest rates on installment loans no credit check tend to be higher than interest rates on traditional loans from banks and credit unions. This is because lenders are taking on more risk by lending to borrowers with bad credit or no credit history.

Interest rates on installment loans no credit check can range from 5% to 36%, depending on the lender and your creditworthiness. It's important to compare interest rates from multiple lenders before you choose a loan.

Types of Installment Loans No Credit Check

There are a few different types of installment loans no credit check available, depending on your needs. Here are a few of the most common types:

- Personal loans: Personal loans are a general-purpose loan that can be used for any purpose, such as paying for medical bills, home repairs, or consolidating debt. Personal loans no credit check typically have higher interest rates and shorter repayment terms than traditional personal loans from banks and credit unions.

- Auto loans: Auto loans no credit check allow you to finance the purchase of a car without having to put down a large down payment. However, interest rates on auto loans no credit check are typically higher than interest rates on traditional auto loans.

- Payday loan alternatives: Payday loan alternatives are a type of small-dollar loan that is designed to be a more affordable and less risky alternative to traditional payday loans. Payday loan alternatives typically have lower interest rates and longer repayment terms than traditional payday loans.

- Credit union loans: Some credit unions offer installment loans to members with bad credit or no credit history. Credit union loans typically have lower interest rates and longer repayment terms than installment loans from other lenders.

- Online loans: There are a number of online lenders that offer installment loans to borrowers with bad credit or no credit history. Online loans can be a convenient way to get a loan quickly, but it's important to compare interest rates and fees from multiple lenders before you choose a loan.

It's important to note that not all installment loans no credit check are created equal. Some lenders may have hidden fees or predatory lending practices. It's important to do your research and compare offers from multiple lenders before you choose a loan.

Here are some tips for finding a reputable installment loan no credit check lender:

- Read reviews from other borrowers before you choose a lender.

- Make sure the lender is licensed and insured.

- Ask about the lender's interest rates, fees, and repayment terms.

- Be sure to understand the fine print before you sign any loan agreement.

How to Qualify for an Installment Loan No Credit Check

The qualifying requirements for an installment loan no credit check will vary depending on the lender. However, most lenders will require you to meet the following basic criteria:

- Be at least 18 years old

- Have a valid Social Security number

- Have a valid bank account

- Have a regular source of income

Some lenders may also require you to have a minimum monthly income or a debt-to-income ratio below a certain threshold.

To apply for an installment loan no credit check, you will typically need to provide the lender with the following information:

- Your name, address, and contact information

- Your employment status and income

- Your bank account information

- The amount of money you need to borrow and the purpose of the loan

Once you have submitted your application, the lender will review your information and make a decision about whether to approve your loan. If your loan is approved, you will typically receive the funds within a few days.

Here are some tips for increasing your chances of qualifying for an installment loan no credit check:

- Have a steady source of income.

- Have a low debt-to-income ratio.

- Provide the lender with accurate and complete information.

- Be prepared to answer any questions the lender may have.

It's important to note that installment loans no credit check can be expensive, so it's important to only borrow what you need and to make sure you can afford the monthly payments. If you're considering an installment loan no credit check, be sure to compare offers from multiple lenders before you choose a loan.

Comparing Installment Loan Lenders

When comparing installment loan lenders, it's important to consider the following factors:

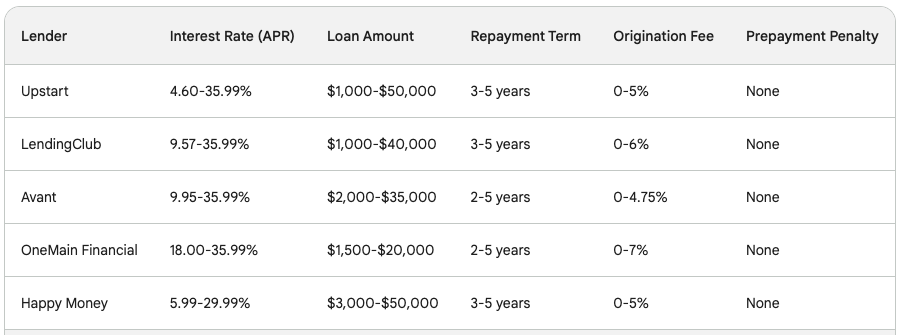

- Interest rates: Interest rates on installment loans no credit check can vary significantly, so it's important to compare offers from multiple lenders before you choose a loan.

- Fees: Some lenders may charge origination fees, prepayment penalties, or other fees. Be sure to ask about all of the fees associated with the loan before you sign any loan agreement.

- Repayment terms: Installment loans no credit check typically have shorter repayment terms than traditional loans from banks and credit unions. Make sure you can afford the monthly payments before you choose a loan.

- Customer service: It's important to choose a lender with good customer service. Read reviews from other borrowers to get an idea of the lender's reputation.

Please note that these are just general estimates, and the actual interest rate, loan amount, repayment term, fees, and penalties may vary depending on your individual circumstances. Be sure to compare offers from multiple lenders before you choose a loan.

Here are some tips for comparing installment loan lenders:

- Get pre-approved from multiple lenders. This will give you an idea of the interest rates and fees you can expect to pay.

- Read the fine print of all loan agreements before you sign. Make sure you understand the terms of the loan, including the interest rate, fees, and repayment terms.

- Ask questions. If you don't understand something, be sure to ask the lender to explain it to you.

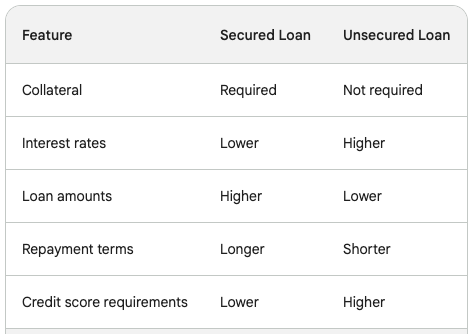

It's also a good idea to compare installment loan lenders to other types of loans, such as secured loans and payday loan alternatives. This will help you determine which type of loan is the best fit for your needs.

Repaying Your Installment Loan No Credit Check

Repaying your installment loan no credit check is important for a few reasons. First, it will help you improve your credit score. When you make your loan payments on time and in full, it shows lenders that you are a reliable borrower. This can lead to lower interest rates and better loan terms in the future.

Second, repaying your installment loan no credit check will help you avoid late fees and penalties. Late fees can add up quickly, and they can make it more difficult to repay your loan. Penalties can also damage your credit score.

Finally, repaying your installment loan no credit check will help you avoid debt collection. If you default on your loan, the lender may send you to collections. This can damage your credit score and make it difficult to get a loan in the future.

Here are some tips for repaying your installment loan no credit check:

- Create a budget. This will help you track your income and expenses and make sure you have enough money to make your loan payments on time.

- Set up automatic payments. This is the best way to ensure that you never miss a loan payment.

- Pay more than the minimum payment. This will help you repay your loan faster and save money on interest.

- If you have trouble making a payment, contact your lender right away. They may be able to work with you to create a payment plan.

Here are some additional tips for repaying your installment loan no credit check:

- Look for ways to increase your income. This could involve getting a part-time job, starting a side hustle, or asking for a raise at work.

- Cut back on unnecessary expenses. This could involve eating out less, canceling unused subscriptions, or shopping around for cheaper insurance rates.

- Consider getting a debt consolidation loan. This can help you combine your debts into one monthly payment, which can make it easier to manage your finances.

Repaying your installment loan no credit check may not be easy, but it is important to do so. By following these tips, you can make the process easier and improve your financial situation.

Tips for Getting the Best Deal on an Installment Loan No Credit Check

Here are some tips for getting the best deal on an installment loan no credit check:

- Shop around and compare offers from multiple lenders. This will help you find the lender with the lowest interest rate and fees.

- Get pre-approved for a loan before you apply. This will give you an idea of the interest rate and fees you can expect to pay, and it will also show lenders that you are a serious borrower.

- Negotiate with the lender. If you have multiple offers, you may be able to negotiate with the lender to get a better interest rate or lower fees.

- Read the fine print of all loan agreements before you sign. Make sure you understand the terms of the loan, including the interest rate, fees, and repayment terms.

- Ask questions. If you don't understand something, be sure to ask the lender to explain it to you.

Here are some additional tips for getting the best deal on an installment loan no credit check:

- Improve your credit score before you apply. The higher your credit score, the lower your interest rate will be. You can improve your credit score by making all of your payments on time and in full, keeping your credit utilization low, and disputing any errors on your credit report.

- Offer collateral. If you have collateral, such as a car or home, you may be able to get a lower interest rate on your loan.

- Co-signer. If you have a co-signer with good credit, they may be able to help you get approved for a loan or get a lower interest rate.

It's important to remember that installment loans no credit check can be expensive, so it's important to only borrow what you need and to make sure you can afford the monthly payments. If you're considering an installment loan no credit check, be sure to compare offers from multiple lenders before you choose a loan.

Conclusion

Installment loans with no credit check provide a valuable financial alternative for individuals facing unexpected expenses or those with less-than-ideal credit histories. By understanding the benefits, considering the potential drawbacks, and choosing a reputable lender, borrowers can unlock the door to financial freedom and regain control of their economic well-being. Remember, responsible borrowing and timely repayments are the keys to maximizing the benefits of installment loans with no credit check.

Frequently Asked Questions

What is an installment loan with no credit check? An installment loan with no credit check is a type of borrowing where lenders assess your ability to repay the loan based on income and other factors rather than conducting a traditional credit check. This makes it accessible to individuals with poor or limited credit histories.

How does the no credit check process work? Instead of relying on credit history, lenders focus on other criteria such as income and employment status to evaluate your eligibility for a no credit check installment loan. This streamlined process enables quicker approval and disbursement of funds.

What are the typical repayment terms for these loans? Repayment terms for installment loans with no credit check vary, but they commonly range from a few months to several years. Borrowers have the flexibility to choose a repayment schedule that aligns with their financial situation.

Are interest rates higher for no credit check installment loans? Yes, interest rates for these loans may be higher compared to traditional loans. Lenders take on higher risk by not assessing credit history, and the interest rates reflect this increased risk.

Can I build or improve my credit with a no credit check installment loan? Yes, responsible borrowing and timely repayment of a no credit check installment loan can positively impact your credit history. Some lenders may report your payment activity to credit bureaus, potentially improving your credit score.

Is collateral required for these loans? No, most installment loans with no credit check are unsecured, meaning they do not require collateral. This makes them more accessible to a broader range of borrowers.

How quickly can I get approved and receive funds? The approval process for no credit check installment loans is generally quicker than traditional loans. Borrowers can often receive approval within a few hours, and funds may be deposited into their account on the same day or within a short period.

What happens if I miss a payment on my installment loan? Missing a payment on your installment loan can result in late fees and negatively impact your credit score. It's crucial to communicate with your lender if you anticipate difficulties in making a payment to explore potential solutions.

Are there limits on the loan amount I can borrow without a credit check? Loan amounts for installment loans without a credit check vary by lender, but they are often influenced by your income and ability to repay. Generally, these loans are available for both small and larger amounts.

How do I find a reputable lender for a no credit check installment loan? Researching online reviews, checking for accreditation, and verifying the lender's terms and conditions are essential steps to finding a reputable lender. Ensure transparency and fair practices before entering into any loan agreement.